April 19th, 2019

Cryptocurrency and Divorce – Hidden Assets

Posted in: Family Law Tagged: Monica Garcia Harms

Author: Monica Garcia Harms, Christopher B. Kaczmarek

Understanding cryptocurrency and the questions to ask to locate it is imperative in any divorce to ensure a fair and equitable division of assets.

The increasing importance of cryptocurrency is no secret. Bitcoin, the most popular cryptocurrency across the globe, currently occupies a market cap of over $93.3 trillion, with an individual Bitcoin is worth just over $5000 at the time of writing this article. Cryptocurrency has made headline after headline not only for its extremely volatile nature but also for the aura of mystique that surrounds this new form of currency.

Given its meteoric rise to prominence, cryptocurrency should be taken very seriously by every family law attorney seeking a fair and equitable division of their clients’ assets. This article will scratch the surface of what cryptocurrency is, how it came into being and whether it can be tracked. Finally, approaches for identifying the nature and history of a party’s cryptocurrency holdings in family law matters will be discussed.

What is Cryptocurrency? Links in the Chain

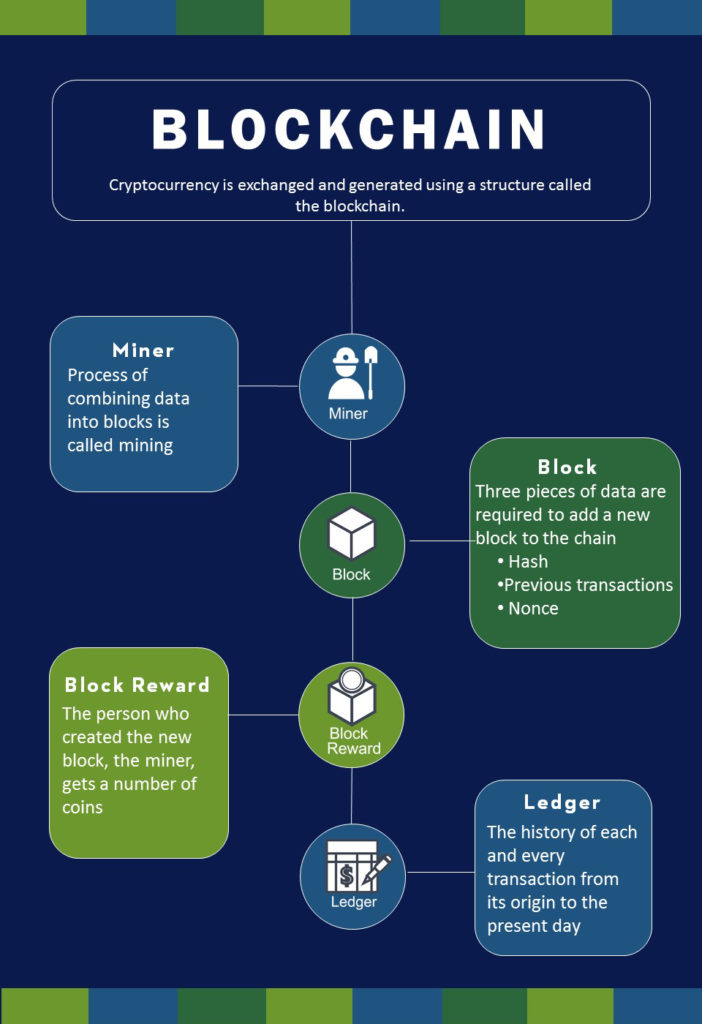

To understand how to approach cryptocurrency in a divorce scenario, one must understand how cryptocurrency comes into being, and how it is used. Cryptocurrency is exchanged and generated using a structure called the blockchain. The goal of the blockchain is to continually add blocks to the chain, and earn Coins (the base unit of any cryptocurrency system) by doing so. Three pieces of data are required to add a new block to the chain – a hash (or code) of the previous block, one or more transactions and a number that solves a very complex math problem (known as a nonce). When all three of these data are combined, a new block is formed, the person who created the new block gets a number of coins and the process repeats itself. The process of combining these data into a new block on the chain is known as mining a given cryptocurrency.

Each cryptocurrency’s blockchain is public, and provides important information to other participants in the ecosystem. Namely, it identifies how much money participants to a transaction are sending and receiving, and provides “keys” (or code names) for the payor and recipient. Furthermore, because every block on the chain is publicly available on the chain’s “ledger,” the history of each and every transaction from its origin to the present day is publicly available. Access to the information provided on the ledger will be highly relevant to participants in a family law case in which cryptocurrency is at issue.

It is important to note that each coin is not a physical entity, but rather a secret code that can be entered like a one-time password, in furtherance of a transaction. When the coin is transferred, the function of “hashing” (or encoding) the old transaction will change the secret code associated with the coin in question. Furthermore, because the entire history of all transactions on the blockchain is made public via its ledger, a user cannot use the same code to “double-pay” with a single coin.

How is Cryptocurrency Used? What’s Mined is Mine

There are two ways to store cryptocurrencies in “wallets”: storing the coins on physical media such as a USB drive (known as a physical wallet) or the using the services of an online service and/or cryptocurrency exchange (known as a digital wallet).

Storing cryptocurrency with a physical wallet is similar to storing cash or gold in a safe. The owner of a coin can store his or her bitcoins on a hard drive or similar device, and connect the device to the internet only when using the coins to make a transaction. This storage method insulates the user’s cryptocurrency from risk of theft, and is generally the method by which savvy and/or experienced cryptocurrency users will store their coins.

Storing cryptocurrency with a digital wallet is similar to a cross between an online bank and brokerage account in that it allows the user to both send and receive cryptocurrency. Online wallets are accessed on a website, and ubiquitous to the point that they generally enable the user to interact with their coins from their computers, phones, tablets, and other devices.

Currency exchanges enable cryptocurrency holders to use their coins to make purchases, or to make sales in exchange for coins. In an exchange, each wallet will have “private keys”— unique identifiers that serve as the “password” to a wallet. Furthermore, each user will have a “public key” – a unique identifier that allows other users to pay them coins. Even if the currency is stored on a physical device, a user will very likely be registered with an exchange in order to engage in transactions using his or her coins.

Most cryptocurrency exchanges, and especially the most popular ones (such as Kraken, Coinbase, and other exchanges) perform some level of Know Your Customer/Anti-Money Laundering due diligence before allowing users to make use of the exchange. Therefore, in the vast majority of cases, the exchange will likely have data concerning the identity of their customers. However, it is unclear how responsive these exchanges will be to subpoenas.

Is Cryptocurrency Trackable? Shedding Light on the Dark Web

While cryptocurrency is broadly understood to be an anonymous form of payment, and conjures up images of the so-called “dark web,” most forms of cryptocurrency are only pseudo-anonymous. When the right questions are asked, and the proper procedures are followed, cryptocurrencies can be tracked in the context of family law cases.

Two key data points regarding the traceability of not only cryptocurrencies, but the transactions that have been effectuated using coins lie within the foundation of the blockchain itself. First, as has been previously discussed, in order for a new block to be “proper”, it must contain a hash of the previous block. Second, an essential component of each block is that each transaction is included. Therefore, each and every transaction made with a given form of cryptocurrency is publicly available on its blockchain.

Furthermore, and perhaps more crucially, every wallet can be uniquely identified through its private and public keys. Since each wallet’s private key is a unique identifier, once the key is disclosed, then the identity of the person behind that wallet in addition to every transaction made with that wallet will be known. This is analogous to a writer’s pen name in that once an author’s pen name is disclosed, it is simple to then identify each and every book that she has written.

With the above in mind, it is worth noting that two relatively popular cryptocurrencies – “Darkcoin” and “Zcash” are designed with total anonymity in mind. Tracking the owners of these coins and the subsequent transactions made will prove to be much more challenging than tracking other coins.

Takeaways for Divorcing Parties

As cryptocurrency is quickly rising in popularity, and may initially appear to be an attractive avenue for less-than-scrupulous parties to attempt to “hide” money, it is essential that discovery include questions concerning the opposing party’s potential cryptocurrency holdings.

Having an Attorney who knows how to structure interrogatories and document requests in order to uncover cryptocurrency holdings and transactions is critical if you suspect your spouse may be using cryptocurrency to hide money. If an initial thread can be found, pulling on it will likely lead to the identity of the exchange.

Monica Garcia Harms co-chairs the Family Law department at Stein Sperling. Her thorough knowledge and understanding of her clients’ circumstances and needs distinguish her approach to the practice of family law. Monica represents clients in complex matters including divorce, contested custody, support and property allocation.