Date of Event: Tuesday, January 10, 2023

What Financial Professionals Need to Know About The Secure Act 2.0

The Secure Act 2.0, part of the omnibus spending legislation, makes numerous changes in the retirement plan law. It raises in 2023 the usual age when minimum distributions must commence to 73. It increases the…

Date of Event: September 29, 2022

Get Schooled on Sending Your Kids to College

Dropping your student off at college can be both exciting and terrifying for parents and children. During this hour-long round table attorneys from our estates and trusts, family, and criminal/personally injury departments will discuss potential…

Date of Event: Tuesday, January 19, 2021

The Tax and PPP Provisions of the Emergency Coronavirus Relief Legislation

Besides overriding the IRS and permitting the deduction of wages and other expenses paid with forgiven PPP loans, the long-anticipated Emergency Coronavirus Relief Legislation contains numerous other tax provisions such as a second recovery rebate…

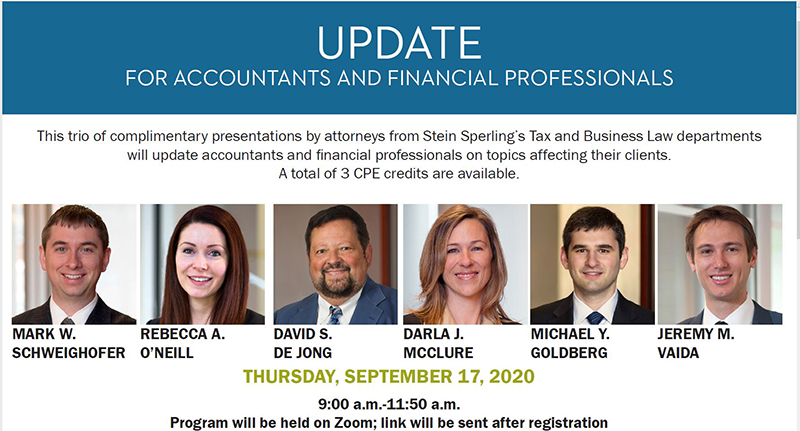

Date of Event: Thursday, September 17, 2020

September Update for Accountants and Financial Professionals

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available. PPP…

Date of Event: Tuesday, January 28, 2020

The SECURE Act: Dramatic Changes in Retirement Rules & Other Late December 2019 Tax Provisions

After legislation languished for many months, Congress recently passed the Setting Every Community Up for Retirement Enhancement Act (SECURE Act). David De Jong and Steven Widdes with Stein Sperling’s Tax and Estates and Trusts departments…

Date of Event: Tuesday, October 22, 2019

October Update for Accountants and Financial Planners

This trio of presentations by attorneys from Stein Sperling’s Tax Law department will update accountants and financial planners on topics affecting their clients. A total of 3 CPE credits are available. Cryptocurrency and the IRS…

Date of Event: April 30, 2019

A Subcontractor’s Survival Guide: Collecting Your Money

Download the slides from this event. Cashflow is essential to the survival of any business – particularly in the construction industry. Owners and contractors may offer a variety of reasons for why they are not…

Date of Event: Wednesday, May 29, 2019

A Subcontractor’s Survival Guide: Contracting & Employment

Construction Contracts are often detailed, complex and intricate. This presentation will focus on risk allocation relating to: incorporation by reference of proposals/prime contracts; scope of work; notice issues; change order and change directive provisions; damage…

Date of Event: Jan. 10, 2019

Update for Accountants and Financial Planners

This trio of presentations will update accountants and financial planners on topics affecting their clients. Attorneys from Stein Sperling’s Tax and Business Law groups will offer three sessions for a total of 3 CPR credits…