August 10th, 2020

Executive Order Suspends Collection of Certain Employee Payroll Taxes

Posted in: Tax Law Tagged: Coronavirus, David S. De Jong

Author: David S. De Jong

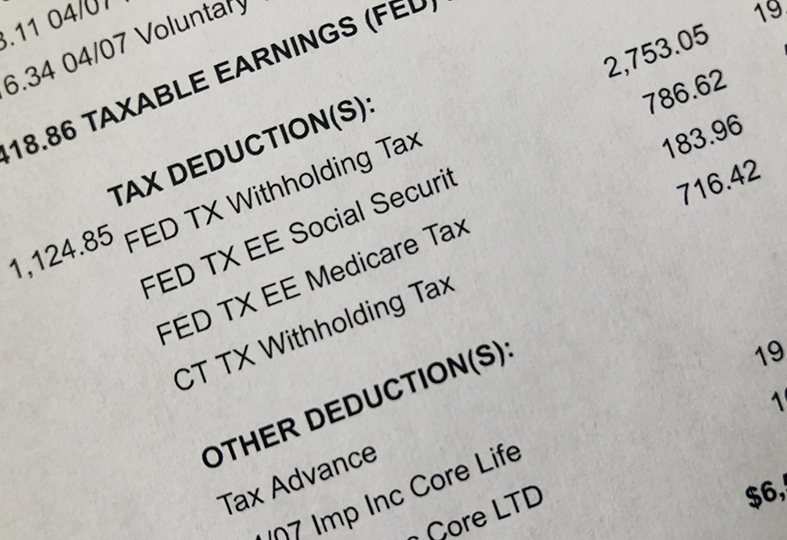

President Trump issued an Executive Order on August 8, 2020, postponing the withholding, deposit and payment of the employee portion of Social Security taxes from September 1, 2020 until after yearend in the case of employees whose gross pay is generally less than $4,000 biweekly or its equivalent. The employer must elect to participate in the deferral.

This directive, issued with additional orders extending certain unemployment benefits, suspending payments on certain student loans and suspending certain foreclosures and evictions, has met with criticism and nonparticipation.

Concerning to employers is the lack of protection from employer liability and ensuing Trust Fund Recovery Penalty exposure of responsible individuals if the deferred taxes go unforgiven and cannot be collected from employees due to departure, hardship or other reasons. Concerning to employees is the reduced net pay from repayment in the form of a double deduction from January-May, 2021.

You can find more on issues affecting businesses and individuals in our COVID-19 Resource Center.