January 26th, 2022

Get Paid Through Peer-to-Peer Apps? Be Aware of New IRS Reporting Requirements

Posted in: Featured Tax Law Tagged: Morgan M. Kirby

Author: Morgan M. Kirby

The Internal Revenue Service has made significant changes to income reporting requirements for 2022 by all third-party payment processors such as Venmo, PayPal and Cash App. They must report payments for goods and services reaching an aggregate $600 or more during the year to the IRS on form 1099-K. Previously, third-party settlement organizations reported transactions on behalf of a participating payee that exceeded 200 transactions or $20,000 during the calendar year. The reporting requirement for payment cards, which also report on form 1099-K, has not changed for 2022.

These new requirements are just the latest in the federal government’s efforts to close the tax gap and reduce unreported income. It is important to note that these new rules represent a change in tax reporting requirements but not a change in tax law. Taxpayers have always been required to report income from all sources on their tax returns regardless of whether that income is reported to the IRS on an information return.

Self-employed and small business owners are likely accustomed to their credit card and debit card receipts being reported on form 1099-K. However, taxpayers receiving side-income from these apps may be surprised to know that the IRS is aware of some, if not all, of their additional income including that from vacation rentals by owner, sales of craft goods, and service income. Under prior reporting requirements, the IRS would usually be completely unaware if a taxpayer omitted side income from an Individual tax return. Under the new requirements, taxpayers who fail to report their additional income are more likely to be caught and subjected to additional interest and penalties as well as the added tax for their failure to comply with the law.

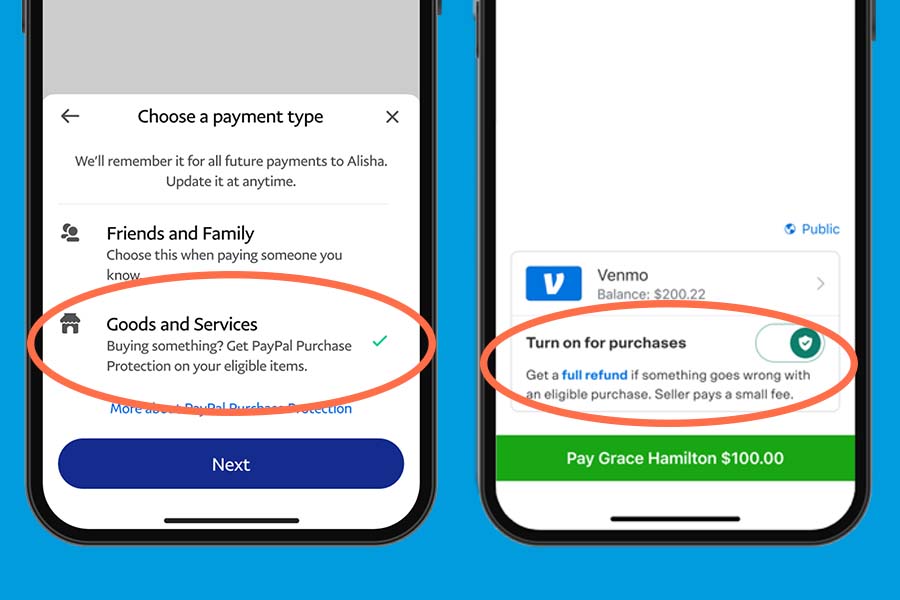

This change will not impact taxpayers who use third-party payment platforms for personal transactions. While many apps have a method for distinguishing between personal and business payments, this method varies for each app.

Users should pay close attention to the instructions and options available when transferring funds to ensure that they are not erroneously classified as a commercial payment. If a taxpayer fails to properly classify a third-party payment transaction and erroneously receives a 1099-K, the taxpayer must either contact the third-party payment site to request a correction or explain to the IRS why the amount reported on form 1099-K is not income.

For taxpayers who are using third-party payment sites for business transactions, it is also important to keep proper records of all related business expenses. These expenses, which are not reported to the IRS, are essential to offsetting taxable income from the business. Taxpayers who were not reporting their side income in prior tax years will need to start keeping records of related expenses in order to deduct them on their 2022 tax return as an offset to income.