October 4th, 2024

New Maryland Wage Disclosure Law Takes Effect: What Employers Need to Know

As of October 1, 2024, Maryland’s new wage transparency law, the Wage Range Transparency Act, is officially in effect. This legislation is designed to promote transparency and ensure equal pay for equal work across the…

May 9th, 2024

Senior Fraud Awareness Day: Ensuring Your Loved Ones Aren’t Victims

Did you know seniors lost an estimated $3.1 billion annually to financial scams and fraud? Shockingly, the total losses of fraud reported by elderly victims have increased 84% since 2021. May 15th is National Senior…

April 25th, 2024

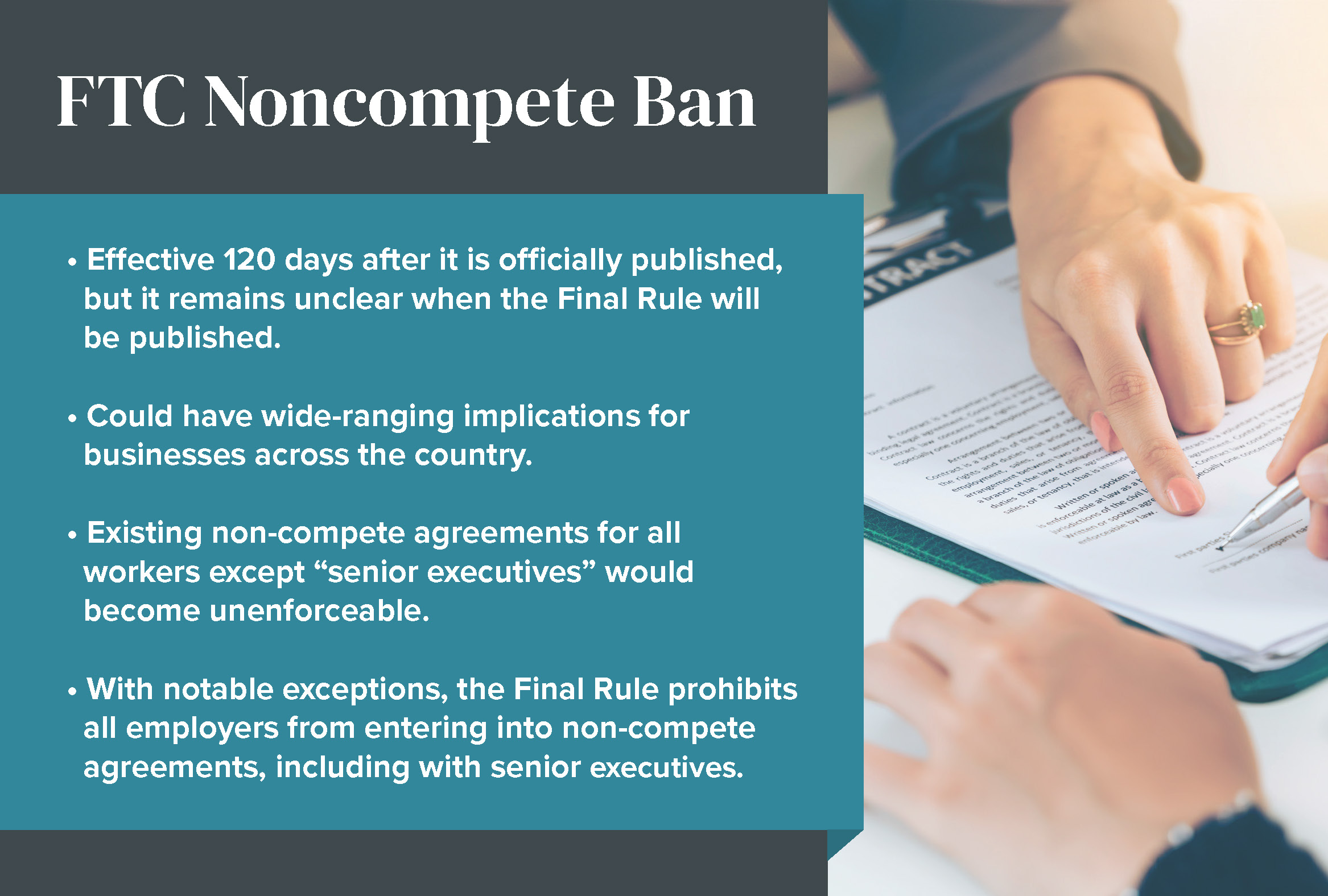

FTC Issues Ban on Noncompete Agreements

On April 23, 2024, the Federal Trade Commission (FTC) announced a Final Rule, applicable to for-profit employers, that would prohibit the enforcement of most “noncompete” clauses—those clauses that prohibit “workers” from seeking or accepting competing…

April 9th, 2024

Podcast: David De Jong Talks About Tax Implications of Catching a Record-Breaking Baseball

As the Major League Baseball season kicks off, tax attorney David De Jong shares insights with Money Life with Chuck Jaffe on what you have to consider from the tax perspective if you’re fortunate enough…

April 1st, 2024

Estate Planning Jitters? You Asked, We Answered During This Key Month!

Why Do I Need a Will (or any estate planning for that matter)? First and foremost, you want to remain in control of your final dispositive wishes. If you die without a Will, you will die “intestate.” Dying intestate…

February 27th, 2024

Dos and Don’ts of Co-Parenting

Effective co-parenting involves navigating a delicate balance between shared responsibilities and respectful communication, all while dealing with some strong emotions. Open and honest communication becomes a crucial ally, with conversations focusing on your child’s continued…

February 11th, 2024

Winning the Heart of a Business Owner

As the season of love approaches, there will be many love letters making the rounds, but the “Be Mine” message that matters most to a business owner or an interested buyer courting the business owner’s…

February 8th, 2024

Why Millennials Are Embracing the Pre-nup and You Should Too

Prenuptial Agreements (“pre-nups”) have historically been associated with a negative stigma or a bad omen for marriage. As well as the misconception that only wealthy individuals need them. However, the number of couples entering into…

February 5th, 2024

For Purposes of FLSA Many Workers Currently Treated as Independent Contractors May Need to be Reclassified

The U.S. Department of Labor (DOL) recently implemented a significant change in the classification of employees and independent contractors under the Fair Labor Standards Act (FLSA), which is a federal law that applies to most…

February 1st, 2024

Pulling Back the Curtain on Insurance

As February 1st marks National Car Insurance Day, it’s an opportune moment to reflect on the often-overlooked importance of safeguarding ourselves on the road. While it may not boast the glamour of holidays like Valentine’s…