February 18th, 2021

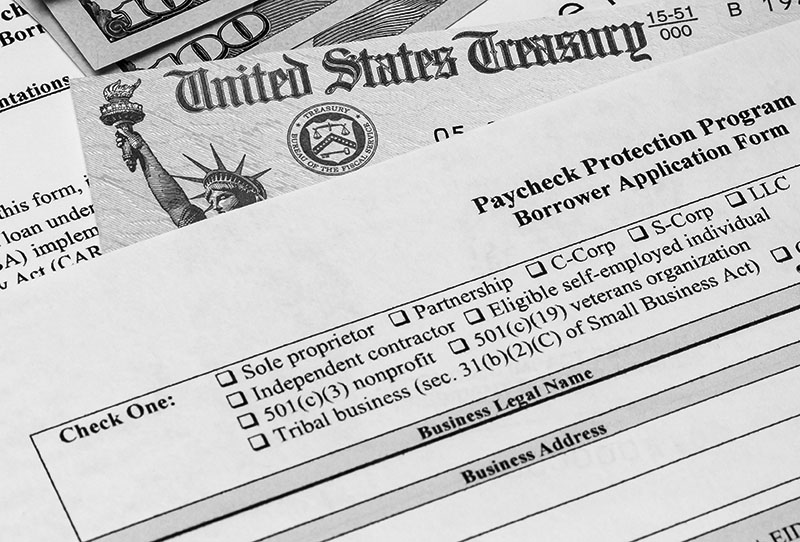

How do PPP funds affect the sale of your business?

Posted in: Business Law Featured Tagged: Andrew L. Schwartz, Coronavirus, Rebecca A. O'Neill

Author: Andrew L. Schwartz, Rebecca A. O'Neill

If you are a business owner, received Paycheck Protection Program (“PPP”) funds under the CARES Act and are now considering selling your business, there are certain key considerations you must be aware of prior to closing on any change in ownership transaction.

On October 2, 2020, the Small Business Administration (“SBA”) issued a Procedural Notice providing information concerning the required procedures for changes of ownership of an entity that has received PPP funds.

For purposes of the PPP, a “change of ownership” is defined as the occurrence of any of the following:

- At least 20% of the common stock or other ownership interest of a PPP borrower (including a publicly traded entity) is sold or otherwise transferred (whether in one or more transactions, including to an affiliate or an existing owner of the entity);

- The PPP borrower sells or transfers 50% or more of its assets whether in one or more transactions; or

- A PPP borrower is merged with or into another entity.

PPP Lender – Notice & Consent

Prior to closing on any change of ownership transaction, the PPP borrower must notify its PPP lender in writing of the proposed transaction and provide the PPP lender with a copy of the proposed agreements and other relevant transaction documents. Failure to obtain the written consent of the PPP lender prior to closing may constitute a default under the PPP promissory note.

Note that, in addition to PPP lender consent, depending on the circumstances of the change of ownership, SBA approval may be required.

When SBA Approval is NOT Required

- SBA approval is NOT required if, prior to closing, the PPP loan has been repaid in full.

- SBA approval is NOT required if the PPP borrower has completed the loan forgiveness process and either:

- SBA has remitted funds to the PPP lender in full satisfaction of the PPP promissory note; or

- The PPP borrower has repaid any remaining balance that has not been previously forgiven.

- If the PPP promissory note has not been repaid in full, SBA approval is NOT required if the PPP borrower plans to transfer 50% or less of its ownership interests or assets.

- If the PPP promissory has not been repaid in full, and the PPP borrower plans to transfer 50% or more of its ownership interests or its assets, SBA approval will NOT be required so long as the following conditions are satisfied:

- The PPP borrower must complete a loan forgiveness application reflecting its use of all of the PPP loan proceeds and submit it along with supporting documentation to the PPP lender;

- The PPP borrower must set up an interest-bearing escrow account (controlled by the PPP lender) and fund the escrow account in an amount equal to the outstanding balance of the PPP loan and execute an Escrow Agreement satisfactory to the PPP lender; and

- Once the forgiveness process is complete, the escrow funds must be disbursed first to repay any remaining (unforgiven) PPP loan balance plus accrued and unpaid interest.

When SBA Approval is Required

In the event that a change of ownership transaction does not meet the conditions above, then SBA prior approval will be required prior to the change of ownership transaction, and the PPP lender may not approve the change of ownership unilaterally. To obtain SBA’s prior approval for changes of ownership, the PPP lender must submit the following:

- The reason that the PPP borrower cannot fully satisfy the PPP promissory note or escrow the funds;

- The details of the requested change of ownership transaction;

- A copy of the executed PPP promissory note;

- Any letter of intent and the purchase or sale agreement setting forth the responsibilities of the PPP borrower, seller (if different from the PPP borrower), and buyer;

- Disclosure of whether the buyer has an existing PPP loan and, if so, the SBA loan number; and

- A list of all owners of 20% or more of the purchasing entity.

Further, SBA approval of any change of ownership involving the sale of 50% or more of the assets of a PPP borrower will be conditioned on the purchasing entity assuming all of the PPP borrower’s obligations under the PPP loan, including responsibility for compliance with the PPP loan terms. In such cases, the purchase or sale agreement must include appropriate language regarding the assumption of the PPP borrower’s obligations under the PPP loan by the purchasing person or entity, or a separate assumption agreement must be submitted to SBA.

SBA will review and provide a determination within 60 calendar days of receipt of a complete request.

In the event of a sale or other transfer of common stock or other ownership interest in the PPP borrower, or a merger of the PPP borrower with or into another entity, the PPP borrower (and, in the event of a merger, the successor to the PPP borrower) will remain subject to all obligations under the PPP loan.

If the SBA issues any clarifying guidance and/or additional requirements, this article will be updated as that guidance is announced.

We at Stein Sperling can assist you with all aspects of the sale of your business or if you are contemplating purchasing a new business.

You can find more on issues affecting businesses and individuals in our COVID-19 Resource Center.