April 15th, 2020

Tips for Spending PPP Loan Proceeds and Maximizing Loan Forgiveness

Posted in: Business Law Featured Tax Law Tagged: Coronavirus, Mark W. Schweighofer, Rebecca A. O'Neill

Author: Mark W. Schweighofer, Rebecca O'Neill

Jan. 12, 2021 Update: New COVID-19 Relief Legislation Contains Paycheck Protection Program Modifications

The Payroll Protection Program (PPP) has provided a critical lifeline to businesses and their employees. Business owners whose PPP loan applications have been approved now face a new challenge: determining how to properly spend the loan proceeds in order to maximize benefits under the program. This is a crucial issue, as businesses must adhere to rules governing the use of PPP loan proceeds, particularly in order to qualify for maximum loan forgiveness. Although we expect further Small Business Association (SBA) and U.S. Department of Treasury (Treasury) guidance on PPP loan forgiveness at some point, to-date businesses are without clear direction on this topic. This article summarizes what we know at this time and provides suggestions to businesses on how to deploy PPP funds most effectively.

The PPP loan and forgiveness rules can be best understood by considering the objective of the program: to create a source of funds to allow businesses to keep their workforce employed and paid at a substantially similar level as before the COVID-19 crisis began. To incentivize employers to keep their historic level of employees and their salaries, the CARES Act allows loan forgiveness of up to 100% of the loan proceeds that are used for those purposes within a prescribed timeframe. Businesses that decrease the number of full-time/full-time equivalent employees and/or decrease compensation by more than 25% for certain employees from February 15, 2020 through April 26, 2020 face the prospect of a reduction in loan forgiveness. This reduction can be eliminated if, by June 30, 2020, the number of full-time/full-time equivalent employees and salary levels are restored.

Below is a summary of steps businesses can take to make appropriate PPP loan expenditures and to help maximize PPP loan forgiveness, based on analysis of the Cares Act and guidance from the SBA and U.S. Treasury issued to date.

1. Open a separate bank account

Businesses may only spend the PPP loan proceeds on specified business expenses, and they will be required to substantiate the proper use of their PPP loan proceeds to their lenders in order to qualify for loan forgiveness. We anticipate that the SBA, and possibly commercial lenders, will be rigid in their substantiation requirements. To facilitate this process, a business owner’s first step upon receiving PPP loan proceeds should be to open a separate bank account to hold proceeds, and to ensure that they are not comingled with any other business funds. Although a simple step, it will save business owners from having to track down and trace weeks of expenditures after the fact in order to document how the loan proceeds were spent.

2. Understand Permissible PPP Loan Expenditures

Businesses may only use PPP loan proceeds for the following types of expenses:

- Certain payroll cost (which include certain retirement plan contributions and group health premiums paid by the employer);

- Mortgage interest payments (but not for mortgage prepayments or principal payments);

- Rent payments under a lease agreement entered into on or before February 15, 2020;

- Utility payments with suppliers under agreements entered into on or before February 15, 2020;

- Interest payments on any other debt obligations that were incurred before February 15, 2020; and/or

- Refinancing an SBA EIDL loan made between January 31, 2020 and April 3, 2020.

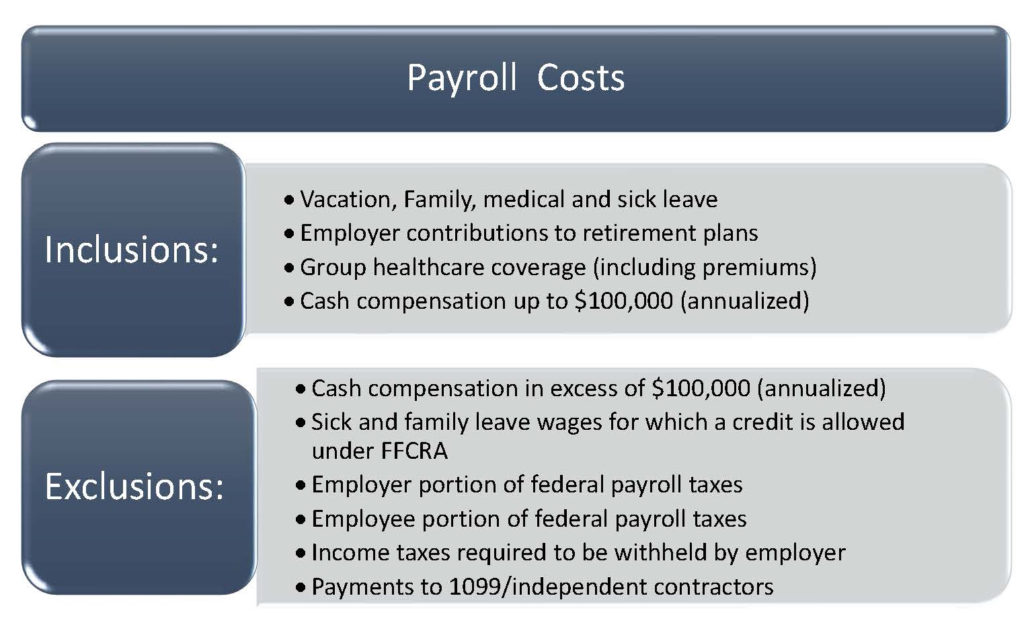

Payroll costs have been a widely discussed topic during the launch of the PPP. For the purpose of determining permissible PPP loan expenditures, payroll costs consist of payment for vacation, parental, family, medical and/or sick leave (subject to certain exceptions, noted below); employer contributions to retirement plans; group healthcare coverage, including insurance premiums; and state and local taxes assessed on employee compensation. Cash salary, commission, wages and tips are also permissible payroll costs, but, for each employee, any cash compensation in excess of $100,000 (on an annual basis) is excluded. Based on the text of the CARES Act, payroll costs do not include the employee portion of federal payroll taxes, employee income taxes required to be withheld by the employer or the employer’s portion of federal payroll taxes[1]. Also excluded are payments to 1099/independent contractors. Note that sick and family leave wages for which a credit is allowed under the Families First Coronavirus Response Act (FFCRA) are also excluded, meaning that a business cannot take advantage of both programs simultaneously.

Summary of Allowable Payroll Costs:

3. Plan for maximum loan forgiveness.

(a) 8 Week Loan Forgiveness Window

A business is eligible for forgiveness of the full principal amount of the PPP loan and any accrued interest provided the business uses all of the loan proceeds for the forgivable purposes over the 8-week period starting on the date the business receives the loan proceeds. Forgivable expenditures are a subset of the overall permissible loan expenditures and consist of the following: (1) payroll costs (as discussed above); (2) mortgage interest payments (but not for mortgage prepayments or principal payments); (3) utility payments with suppliers under agreements entered into on or before February 15, 2020; and (4) rent payments under a lease agreement entered into on or before February 15, 2020. Note that to qualify for maximum forgiveness, 75% of the expenditures must be for payroll costs during the 8-week period. While current guidance is unclear, it appears that employers who spend less than 75% on permitted payroll costs face the prospect of a proportional reduction in loan forgiveness[2]. Accordingly, businesses should take great care to cause payroll expenses to equal or exceed the 75% threshold. A business that finds itself challenged to reach the 75% threshold should consider the expansive definition of payroll costs noted above, which includes employer contributions to retirement plans (including, apparently, contributions that remain to be funded for 2019) and group health premiums, neither of which are subject to the $100,000 compensation cap discussed above. In some instances, it may be permissible to pre-fund these obligations if necessary.

Assuming the 75% threshold is satisfied, the remaining 25% can be utilized to pay rent, mortgage interest, and utilities. While guidance is still evolving, at present it appears a business will be permitted to prepay these expenses to the ensure that the entirety of the PPP funds are used during the 8-week window.

(b) Maintain Records to Substantiate Expenses

As mentioned above, maintaining adequate records is expected to be key to maximizing loan forgiveness. While qualified rent, mortgage, and utility payments are relatively simple to document, payroll costs may prove more complex. In particular, the salary payment cap creates a unique challenge for payroll departments with employees who have annual salaries in excess of $100,000 because each payment will consist of a portion that can be paid from PPP loan proceeds and a portion that must come from existing cash on hand. To date, there has been no official guidance providing insight into the mechanics of making such bifurcated salary payments. At a minimum, businesses should develop a procedure for documenting payments of PPP funds to employees who make in excess of $100,000 annually.

To demonstrate the issue, consider the following example: Business X employs Employee 1 and Employee 2. Employee 1’s salary is $100,000 per year and Employee 2’s salary is $150,000 per year. They both receive salary payments every 2 weeks. Assume for illustrative purposes that Employee 1’s bimonthly payroll cost payments are $3,800, and Employee 2’s bimonthly payroll cost payments are $5,700. Each time Business X pays Employee 1, the entire payroll cost payment of $3,800 can be paid out of the PPP loan proceeds. Each time Business X pays Employee 2, only $3,800 of Employee 2’s total $5,700 payroll cost payment can be paid out of PPP loan proceeds. How should Business X handle paying Employee 2?

One strategy is to draw the maximum allowable amount of salary payment from the PPP loan proceeds account and draw the remaining amount from the business’ existing payroll account. Using the example above, to pay Employee 2 each pay period, Business X would draw $3,800 from the PPP loan proceeds account and the remaining $1,900 from the Business X existing payroll account.

Alternatively, a business might consider paying 100% of an employee’s payroll costs out of the business’ existing payroll account, then reimbursing the business using the PPP loan proceeds account, to the extent of the maximum allowable payroll cost payment for that pay period. Under this approach, continuing with the example above, Business X would pay Employee 2 the full $5,700 out of the Business X payroll account, then transfer $3,800 from the PPP loan proceeds account over to the Business X payroll account, for a net expenditure by Business X of $1,900.

To be clear, neither approach has been discussed by the SBA or Treasury. However, no matter the method of payment ultimately required or permitted by official guidance, a business’ ability to substantiate payroll costs will be essential. In anticipation of this, businesses should prepare payroll cost analyses that compute each employee’s payroll costs, breaking out the cash compensation for each employee during each pay period. Once the PPP loan proceeds arrive, businesses should use the payroll cost analysis to determine the portion of each salary payment that can use PPP loan proceeds. Taking this step will allow businesses to more easily trace and substantiate the amount of each salary payment for each employee, which will enhance the likelihood of qualifying for maximum loan forgiveness. In addition, we strongly recommend that a business remains consistent in its methodology for using PPP funds. When it comes time for the procedures to be audited, either by SBA, a commercial lender or some other entity, we anticipate that consistency will go a long way toward substantiating the proper use of funds.

(c) Consider Effect of Salary Reduction

Under the CARES Act, reducing the salary of employees whose annual cash salary was less than $100,000 in 2019 by more than 25% during the 8-week loan period noted above will cause a dollar-for-dollar reduction in the amount of loan forgiveness for which the business would otherwise be eligible. For the purpose of determining the percentage decrease in salary, an employee’s reduced salary is compared to such employee’s salary during the last completed quarter prior to the 8-week loan period.

However, based on the text of the CARES Act, loan forgiveness is not adversely impacted if compensation that is reduced from February 15, 2020 through April 26, 2020 is restored to pre-February 15, 2020 levels by June 30, 2020. In addition, if there has been a reduction in the number of full-time/full-time equivalent employees during this period, employee numbers must also be restored by June 30, 2020 in order for the business to avoid a reduction in loan forgiveness. The text of the CARES Act does not address the treatment of reductions in compensation occurring after April 26, 2020 that are restored by June 30, 2020, and to date the SBA has not issued any clarifying guidance.

Note that if an employee’s annual cash salary is $100,000 or more, the business can reduce such employee’s annual cash salary by more than 25% (but not below $100,000) without impacting the amount of loan forgiveness. This may create an opportunity for businesses to control costs by examining the compensation paid to its most highly-compensated individuals. While salary reductions are never attractive, such approach would reduce the business’ operational costs without affecting loan forgiveness.

(d) Consider Effect of Full-Time Employee Reduction

To encourage business owners to maintain their full-time employee level, the CARES Act further provides that terminating full-time/full-time equivalent employees (FTEs) during the 8-week loan period will also cause a proportionate reduction in loan forgiveness. This reduction is calculated by multiplying the loan forgiveness amount by the quotient of: the average FTEs during the 8-week loan period divided by the average FTEs during one of two possible time periods to be chosen by the business owner: (1) February 15, 2019 through June 30, 2019; and (2) January 1, 2020 through February 29, 2020. Note that seasonal businesses may only use the former time period.

Note that the loan forgiveness amount will not be curtailed by a reduction of FTEs in limited circumstances. With respect to any reduction in FTEs occurring from February 15, 2020 through April 26, 2020 , the CARES Act provides that if the same number of terminated FTEs are subsequently hired by June 30, 2020, the temporary reduction in workforce will not affect loan forgiveness. Additionally, it appears that it is not necessary that the business re-hire the same employees; rather it appears the test will be based on the number of positions eliminated and restored without regard the employee who fills such positions. Note, however, that if there are both FTE reductions AND salary reductions occurring from February 15, 2020 through April 26, 2020, they must both be restored by June 30, 2020 in order to avoid a reduction in loan forgiveness. The text of the CARES Act does not address the treatment of reductions in the number of FTEs occurring after April 26, 2020 that are restored by June 30, 2020, and to date the SBA has not issued any clarifying guidance.

Although reducing the number of FTEs may appear to be a cost-saving strategy, significant layoffs will likely impair a business’ ability to qualify for loan forgiveness. If a business’ FTE count is reduced significantly during the 8-week loan forgiveness window, the businesses may struggle to spend 75% of the PPP loan proceeds on payroll costs, as is required to qualify for maximum loan forgiveness. Again, one of the principal aims of the PPP is to ensure that businesses have access to capital to continue to pay employees during the current pandemic and we expect strict enforcement of this objective.

Finally, as we await further guidance from SBA, there remain many questions surrounding the impact of a workforce reduction on loan forgiveness. Chief among these questions is whether loan forgiveness will be decreased as a result of unrestored workforce reductions occurring either from February 15, 2020 through April 26, 2020, or during the 8-week loan window, which were planned or otherwise not due to economic hardship caused by the COVID-19 crisis, such as retirements, voluntary employee exits or terminations due to poor performance.

Official guidance on the PPP loans, and loan forgiveness in particular, is evolving. In the absence of final guidance on these critical issues, taking the measures set forth above will help businesses position themselves for the best possible outcome.

You can find more on issues affecting businesses and individuals in our COVID-19 Resource Center.

[1] SBA Final PPP FAQ dated April 8, 2020 appears to directly contradict the plain language of the CARES Act, stating that payroll costs are to be calculated on a gross basis, meaning federal payroll and income taxes imposed and withheld from the salary payments are not to be subtracted. Out of an abundance of caution, we recommend following the letter of the CARES Act and NOT including the federal taxes imposed and withheld on salary payments in the calculation of payroll costs to avoid using the PPP Loan proceeds for an impermissible use, which will cause such amounts to be ineligible for loan forgiveness. If the ultimate guidance on this issue confirms the gross basis interpretation from the SBA Final PPP FAQ dated April 8, 2020, then businesses can add back those tax amounts.

[2] Some commentators have theorized that the 75% requirement may operate as a “cliff”. While we do not believe this interpretation to be correct, it makes the 75% threshold even more important. In a cliff scenario, a business would lose all forgiveness if payroll costs fall below the required threshold.