August 18th, 2023

38 Stein Sperling Attorneys Listed in 2024 Best Lawyers® and Best Lawyers: Ones to Watch®

Stein Sperling is pleased to announce that 25 lawyers have been included in the 2024 Edition of The Best Lawyers in America©. Additionally, 13 lawyers have been included in the 2024 Edition of Best Lawyers:…

December 20th, 2022

35 Stein Sperling Attorneys Recognized by Super Lawyers Maryland on 2023 List

Stein Sperling is proud to announce 35 of its attorneys have been selected for inclusion on the 2023 Maryland Super Lawyers and Rising Stars lists, including attorneys on the Top 10, Top 50, and Top…

December 23rd, 2021

30 Stein Sperling Attorneys Recognized by Super Lawyers Maryland on 2022 List

Stein Sperling is proud to announce 30 of its attorneys have been selected for inclusion on the 2022 Maryland Super Lawyers and Rising Stars lists, including attorneys on the Top 10, Top 50, and Top…

December 14th, 2020

31 Stein Sperling Attorneys Named to 2021 Maryland Super Lawyers List

Stein Sperling is proud to announce 31 of its attorneys have been selected for inclusion on the 2021 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…

August 21st, 2020

16 Stein Sperling Lawyers Named to 2021 Best Lawyers List, 8 on Ones to Watch List

Stein Sperling Bennett De Jong Driscoll PC is pleased to announce that 16 lawyers have been included in the 2021 Edition of The Best Lawyers in America©. Additionally, eight attorneys received 2021 Best Lawyers: Ones…

August 18th, 2020

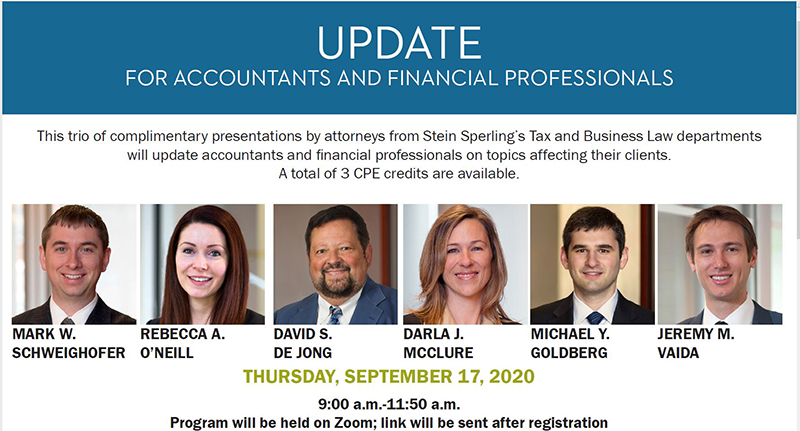

September Update for Accountants and Financial Professionals

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available. PPP…

December 16th, 2019

28 Stein Sperling Attorneys on 2020 Maryland Super Lawyers List

Stein Sperling is proud to announce 28 of its attorneys have been selected for inclusion on the 2020 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…

October 31st, 2019

20 Stein Sperling Attorneys Listed Among “Top Attorneys 2019” in Bethesda Magazine

In their November/December 2019 edition, Bethesda Magazine published a list of top attorneys in Montgomery County. 20 Stein Sperling attorneys—in the areas of Business/Corporate Law, Civil Litigation, Criminal Defense, Family Law, Personal Injury and Trusts…

September 13th, 2019

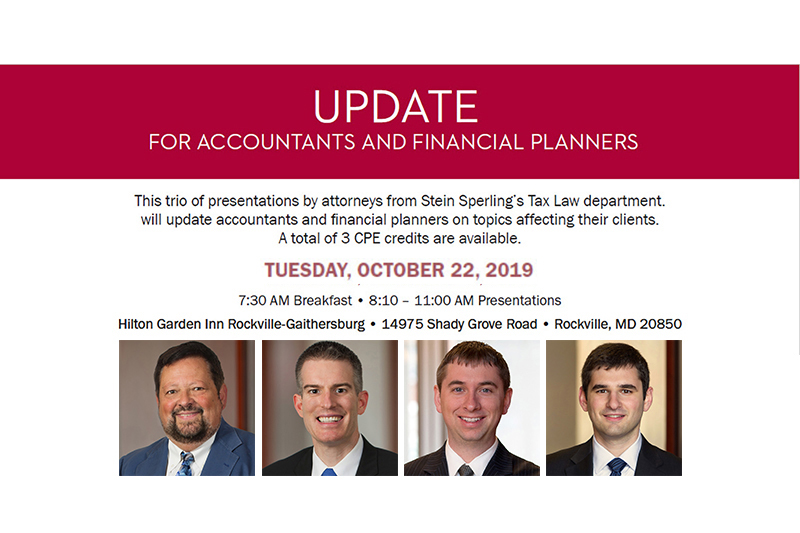

October Update for Accountants and Financial Planners

This trio of presentations by attorneys from Stein Sperling’s Tax Law department will update accountants and financial planners on topics affecting their clients. A total of 3 CPE credits are available. Cryptocurrency and the IRS…

August 29th, 2019

Pay Your Taxes or Lose Your Passport

The Internal Revenue Service has recently begun seeking the revocation of passports of taxpayers who owe back taxes. Previously, the IRS had only been certifying those with seriously deliqunent tax debt to the State Department…