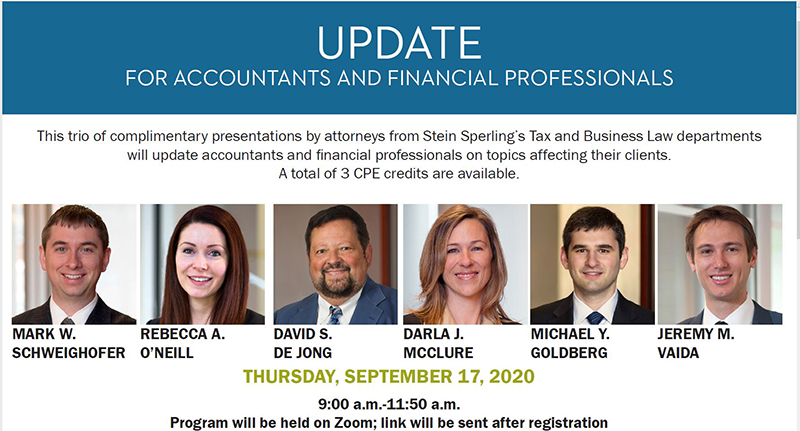

Event Date: Thursday, September 17, 2020

September Update for Accountants and Financial Professionals

Posted in: Tax Law Events Tagged: Darla J. McClure, David S. De Jong, Jeremy M. Vaida, Mark W. Schweighofer, Michael Y. Goldberg, Rebecca A. O'Neill

Time: 9:00 a.m.-11:50 a.m.

Location: Virtual

Speaker: Mark W. Schweighofer, Rebecca A. O'Neill, David S. De Jong, Darla J. McClure, Michael Y. Goldberg, Jeremy M. Vaida

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available.

PPP & Latest COVID Related Tax Developments

The Payroll Protection Program provided a critical lifeline to many businesses in a time of great uncertainty. Presented by Mark Schweighofer and Rebecca O’Neill, this session will provide up to date guidance on steps businesses should take to prepare their loan forgiveness

applications in order to maximize the likelihood of forgiveness.

Multistate Tax and Business Issues in a COVID World

COVID-19 has sent businesses and their employees into a remote world with the end not yet in sight. Meanwhile, states are suffering from reduced income and sales tax revenues and may become more aggressive in pursuing alleged scofflaws. Presented by David De Jong, Darla McClure and Michael Goldberg, this session will look at current issues in multisate taxation, including common situations accentuated by the coronavirus.

Top 5 Tax Traps for the Transnational Worker

In this discussion, Mark Schweighofer and Jeremy Vaida will examine the top five tax and reporting considerations faced by U.S. citizens working abroad. Covered topics will include: foreign contractors vs. foreign wage income; foreign asset reporting obligations; navigating competing social security obligations and the impact of totalization agreements; the impact of tax treaties; and special considerations for foreign retirement accounts.