July 9th, 2025

Highlights of the Tax Provisions of OBBB Act

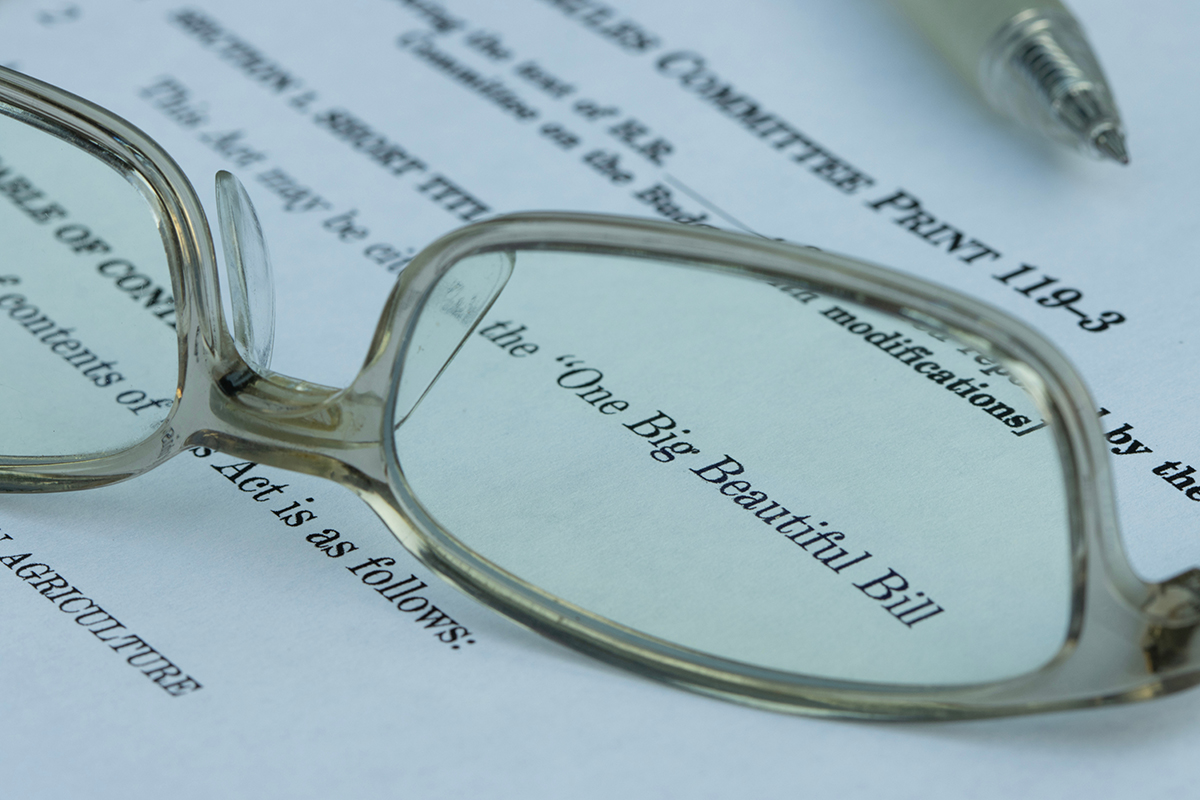

On July 4, 2025, President Trump signed into law the One Big Beautiful Bill Act (OBBB), marking one of the most significant tax reforms in recent years. The sweeping changes to the federal tax code…

July 7th, 2025

June Federal Tax Update

INDIVIDUALS In Beaverdam Creek Holdings v. Commissioner TC Memo 2025-53, the Tax Court concluded that a partnership had claimed a conservation easement based on a “preposterous” financial model and allowed a deduction of about $193,000…

June 11th, 2025

May Federal Tax Update

INDIVIDUALS In Stevens v. Commissioner, TC Memo 2025-45, the Tax Court concluded that a $34.2 million tax deduction for an interest accrual on a “loan” arrangement to offset a business sale for $36.2 million was…

May 8th, 2025

April Federal Tax Update

INDIVIDUALS In Zajac v. Commissioner, TC Memo 2025-33, the Tax Court found that one-half of a $35,001 settlement for the taxpayer’s arrest and incarceration for allegedly beating his wife which charges were dropped when not…

April 8th, 2025

March Federal Tax Update

INDIVIDUALS In Jaha v. Commissioner, TC Memo 2025-26, the Tax Court determined that a husband was domiciled in California rather than Oregon when he earned income from a business such that community property law made…

March 6th, 2025

February Federal Tax Update

INDIVIDUALS In Green Valley Investors LLC v. Commissioner, TC Memo 2025 – 15, IRS reduced a conservation easement deduction from the $90 million that was claimed down to $1.15 million, rejecting arguments intended to avoid…

February 4th, 2025

January Federal Tax Update

INDIVIDUALS In Franklin v. Commissioner, TC Memo 2025-8, the Tax Court determined that a withdrawal of $155,000 by an Alabama county sheriff from an account used to fund meals for jail inmates that was invested…

January 9th, 2025

December Federal Tax Update

INDIVIDUALS In Bruyea v United States, 134AFTR 2d2024-6310, the US Court of Federal Claims became the second court to determine that a treaty-based (in this case Canada) foreign tax credit applies against the Net Investment…

December 19th, 2024

45 Stein Sperling Attorneys Recognized by Super Lawyers Maryland on 2025 List

Stein Sperling is proud to announce 45 of its attorneys have been selected for inclusion on the 2025 Maryland Super Lawyers and Rising Stars lists, including attorneys on the Top 50, and Top 100 lists.…

November 8th, 2024

Stein Sperling Ranked in 2025 Best Law Firms

Stein Sperling has been recognized in the 2025 edition of Best Law Firms®, ranked by Best Lawyers®, nationally in 5 practice areas and regionally in 19 practice areas. For the seventh year in a row,…