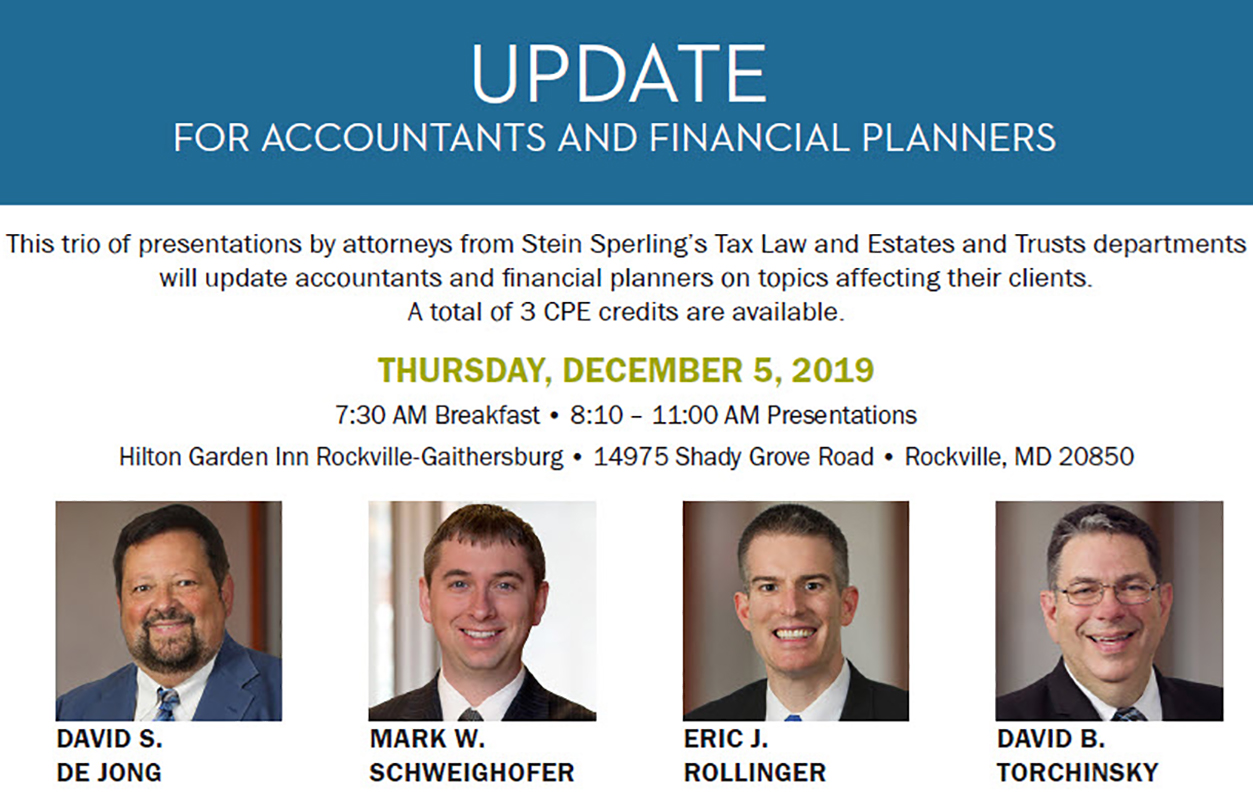

Event Date: Thursday, December 5, 2019

December Update for Accountants and Financial Planners

Posted in: Uncategorized Tagged: David B. Torchinsky, David S. De Jong, Eric J. Rollinger, Mark W. Schweighofer

Time: 7:45 a.m.-11 a.m.

Location: Hilton Garden Inn Rockville-Gaithersburg

Speaker: David De Jong, Eric Rollinger, Mark Schweighofer, David Torchinsky

Three presentations by attorneys from Stein Sperling’s Tax Law and Estates and Trusts departments will update accountants and financial planners on topics affecting their clients. A total of 3 CPE credits are available.

Top 15 Federal Tax Developments of 2019

Although 2019 brought us no major tax legislation for a second year in a row, new regulations and rulings continue to abound along with court decisions interpreting the law. The program will examine the most significant of these 2019 developments and how they may affect tax preparation and/or planning.

Tax Issues on LLC Dissolution

This presentation will focus on the many tax issues LLC owners face in connection with the exit from, or liquidation of, a limited liability company. Topics will include planning strategies for minimizing or deferring gain on exit, strategies for dealing with “hot assets” and planning tips to minimize basis limitation issues. The seminar will also consider many of the common issues that arise in connection with a member’s liquidation of his LLC interest.

A Tax and Financial Analysis of Trump Family Wealth

The New York Times and Washington Post have published lengthy investigative articles describing the borrowing, income minimization and wealth transfer techniques utilized within the Trump family to maximize wealth. Assuming the reporting was accurate, were the steps reasonable, aggressive or beyond? You decide.