April 25th, 2024

FTC Issues Ban on Noncompete Agreements

Posted in: Employment Law Featured Tagged: Darla J. McClure, Dustin M. Dorsino

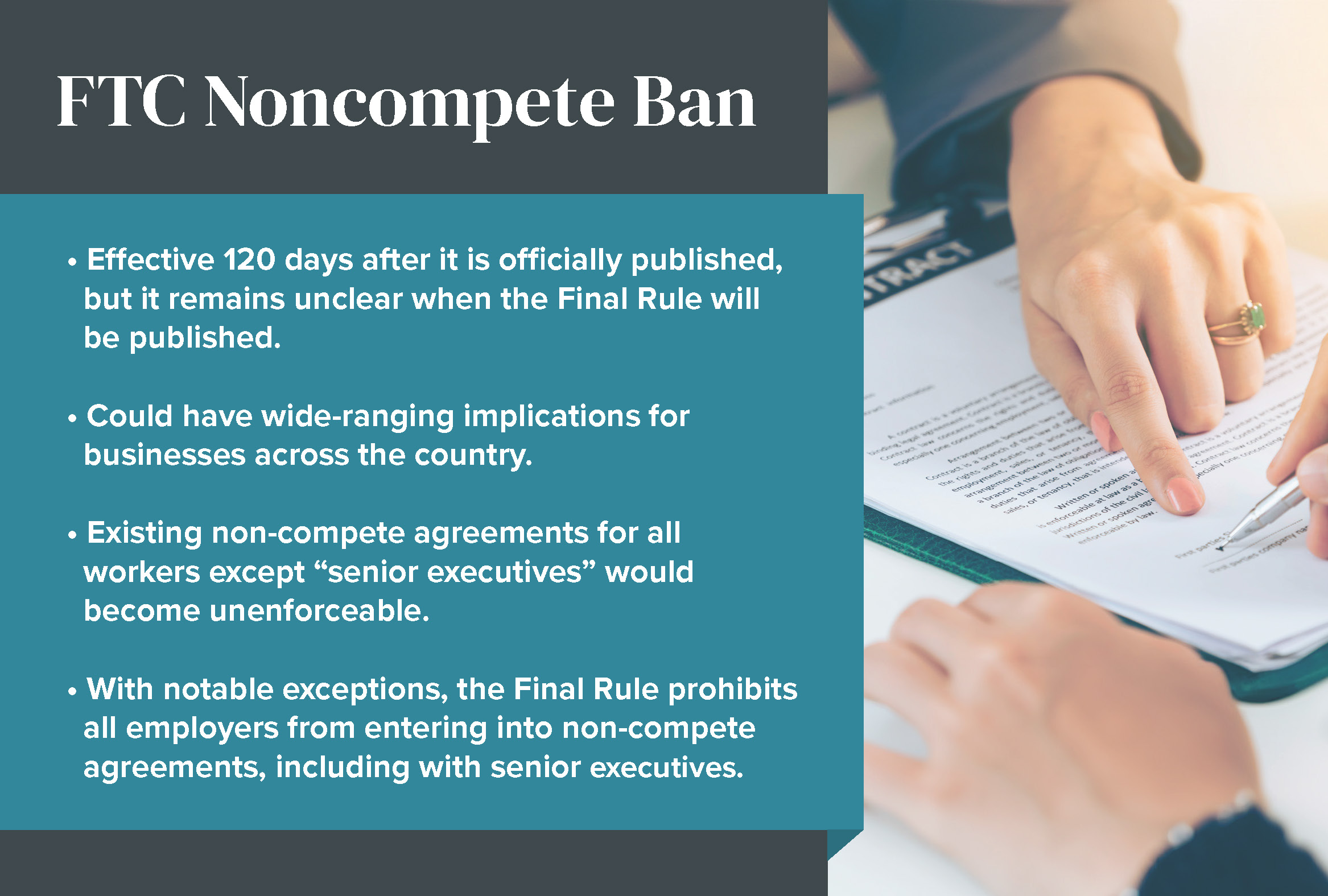

On April 23, 2024, the Federal Trade Commission (FTC) announced a Final Rule, applicable to for-profit employers, that would prohibit the enforcement of most “noncompete” clauses—those clauses that prohibit “workers” from seeking or accepting competing employment after the conclusion of their employment with their current employer. Once it takes effect, the Final Rule would also bar all for-profit employers from entering into any new noncompete agreements with any workers. The Final Rule will become effective 120 days after it is officially published in the Federal Register, unless suspended or overturned by court order. It remains unclear when the Final Rule will be published, thus triggering the 120 day clock.

The Final Rule defines “workers” very broadly, without regard to the worker’s title or whether the worker is an employee, independent contractor, or working under a different title.

The Final Rule could have wide-ranging implications for businesses across the country, and will not come into law without a legal fight. The Final Rule has already been challenged in one federal court on the basis that the FTC did not have the regulatory authority to unilaterally issue the Final Rule. Ryan, a Texas-based tax services and software provider, filed suit in the U.S. District Court for the Northern District of Texas, and the Chamber of Commerce has also announced it intends to file suit challenging the Final Rule. It is foreseeable that this issue could reach the United States Supreme Court before the Final Rule takes effect.

Existing Noncompete Agreements

Under the Final Rule, any existing noncompete agreements for all workers except “senior executives” will become unenforceable after the Final Rule’s effective date. A “senior executive” is defined in the Final Rule as an employee whose total annual compensation1 was more than $151,164 in the preceding year2 and whose position involves policy-making3. Existing noncompete agreements with “senior executives” will remain enforceable.

While employers will not be required to formally amend their contracts with workers, once the Final Rule takes effect, employers will need to provide notice to all workers, other than senior executives, bound by a noncompete clause that the clause will not be enforced. The Final Rule provides model notice for employers to use for this purpose, though this notice may need to be customized depending upon the particular circumstances.

New Noncompete Agreements

The Final Rule prohibits all employers from entering into noncompete agreements after the Final Rule’s effective date, including with senior executives. However, the Final Rule sets forth several exceptions to this prohibition, including:

- Pursuant to a bona fide sale of the assets or equity interests of a business;

- Where a lawsuit or claim was filed relating to the noncompete agreement prior to the Final Rule’s effective date; and

- Where the employer in good faith believes the Final Rule is inapplicable to the enforcement or attempted enforcement of a specific noncompete agreement.

The Final Rule also does not apply to other restrictive covenants employers may enter into with their workers, such as confidentiality and nonsolicitation restrictions. However, if a nonsolicitation covenant is drafted broadly to effectively prohibit, penalize or function to prevent a worker from seeking or accepting work after the end of their employment, then such a provision could be deemed unenforceable as a disguised noncompete under the Final Rule.

Notwithstanding the uncertainty about the ultimate fate of the Final Rule, now is a good time for all employers to revisit their existing noncompete agreements, as well as their confidentiality/nondisclosure and nonsolicitation agreements, to maximize the prospects for their ongoing enforceability, and to prepare communications to workers in the event the Final Rule is held to be enforceable. Stein Sperling can assist with this important work. If you have any questions about the FTC’s Final Rule or how best to prepare for its potential implications, please contact any Stein Sperling attorney.

- The FTC defines “total compensation” to include salary, bonuses, commissions and other nondiscretionary compensation, but not to include any fringe benefits. ↩︎

- The Final Rule makes clear an employer may choose any of the following time periods as the “preceding year”: (i) the most recent 52-week year, (ii) the most recent calendar year, (iii) the most recent fiscal year, or (iv) the most recent anniversary of hire year. ↩︎

- The Final Rule defines a “policy-making position” as a business entity’s president, chief executive officer or the equivalent, any other officer who has policy-making authority, or any other natural person who has policy-making authority similar to an officer. Further, an “officer” includes the business entity’s president, vice president, secretary, treasurer or principal financial officer, comptroller or principal accounting officer, and any natural person routinely performing corresponding functions. ↩︎