September 19th, 2025

Supporting Women in Business: A Legal Perspective

As business, real estate and employment law attorneys practicing in Maryland, we work extensively with women entrepreneurs and executives who face unique challenges in today’s business environment. In honor of American Women’s Business Day, we…

September 8th, 2025

How Maryland’s New Law Helps Divorcing Spouses Avoid Costly Refinancing

In the midst of a life-changing event like divorce, stability is invaluable. To keep the status quo for their family, one party often wishes to stay in the marital home. This used to mean that…

September 5th, 2025

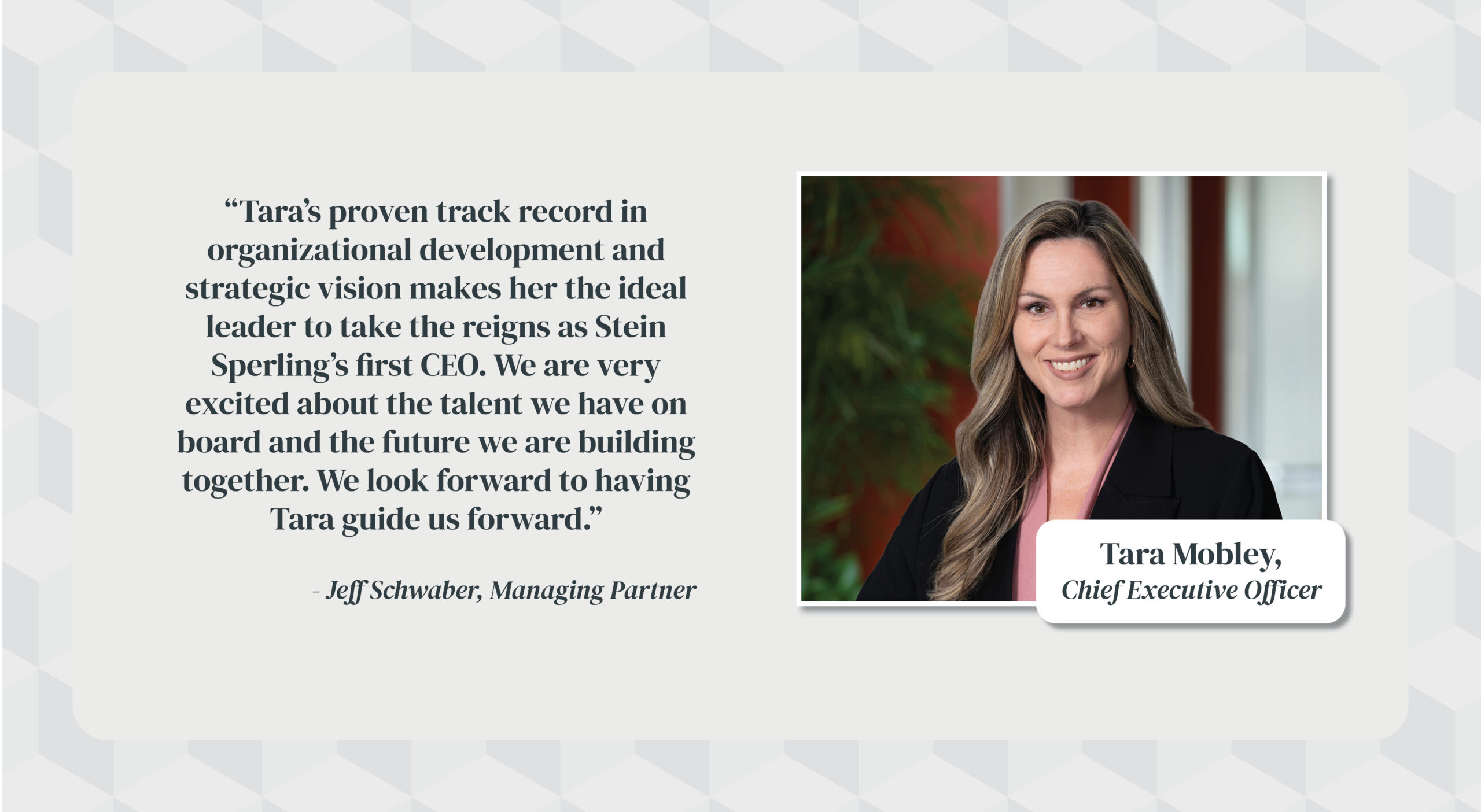

Stein Sperling Welcomes Tara Mobley as the Firm’s First CEO

As Stein Sperling’s commitment to strategic growth and business innovation continues to evolve, we are proud to announce the recent appointment of Tara C. Mobley as the first Chief Executive Officer of our firm. Tara…

September 4th, 2025

Stein Sperling Included in The Daily Record’s Best Companies to Work for in Maryland

Stein Sperling is proud and honored to announce its continued recognition from The Daily Record as one of the “Best Companies to Work for in Maryland,” for the third year in a row. Stein Sperling…

August 21st, 2025

Darla McClure Named As a Best Lawyers of 2026 “Lawyer of the Year” Plus 34 Stein Sperling Attorneys Listed in 2026 Best Lawyers

Stein Sperling Bennett De Jong Driscoll PC is pleased to announce that 23 lawyers have been included in the 2026 edition of The Best Lawyers in America® and 11 lawyers have been included in Best Lawyers:…

August 18th, 2025

David De Jong Shares Highlights of OBBBA in Bloomberg Tax Article

Stein Sperling Tax Law attorney David De Jong recently wrote an article for Bloomberg Tax entitled “GOP Tax Law Gives Entrepreneurs Incentive to Be C Corporations“ Here are some key highlights from the article: Major…

August 12th, 2025

August Federal Tax Update

INDIVIDUALS In Feige v Commissioner, TC Memo 2025-88, the Tax Court rejected multiple arguments of a terminated employee who received 100,000 shares of company stock at the time of her departure and found the value…

August 8th, 2025

July Federal Tax Update

INDIVIDUALS Public Law 119-21, the One Big Beautiful Bill Act (OBBBRA), contains the following provisions: In Mennemeyer v. Commissioner, TC Memo 2025-80, the Tax Court concluded that a $1.5 million post-arbitration settlement was fully taxable…

July 24th, 2025

Dating In the Workplace: Essential Strategies for HR

Workplace relationships are an undeniable reality in today’s professional environment. According to a recent Forbes survey, 60% of adults report having had a workplace romance. As employees spend increasingly more time at work, romantic connections…

July 15th, 2025

NEW TAX ALERT – Maryland Adds 3% Sales Tax to Tech Services

On July 1st, Maryland’s first in the nation Tech Tax took effect. The tax imposes a new 3% levy on a variety of tech services, such as cloud computing, web hosting, e-magazines, software publishing, IT…