January 7th, 2022

The Miller Act: 3 Steps A Subcontractor or Supplier on a Public Project Needs to Take to Make Sure They Are Paid

Posted in: Construction Law Featured Tagged: E. Andrew Cole

Author: E. Andrew Cole

Unlike construction projects in the private sector, contractors cannot file mechanic’s liens on public projects. Enforcement of a mechanic’s lien on a public project would result in a shut-down of publicly owned real estate. The Miller Act and the Little Miller Act bridge this gap.

What are Miller Act and Little Miller Act claims?

The Miller Act and the Little Miller Act provide an alternative mechanism to help subcontractors and material suppliers providing work to applicable general contractors on certain public projects get paid. These laws require a bond to stand in place of the mechanic’s lien right. The bond requirement:

- Encourages the general contractor to promptly pay subcontractors and material suppliers; and

- Provides subcontractors and material suppliers with a level of assurance that they will be paid for the work they provide.

What is the Miller Act and when does it apply?

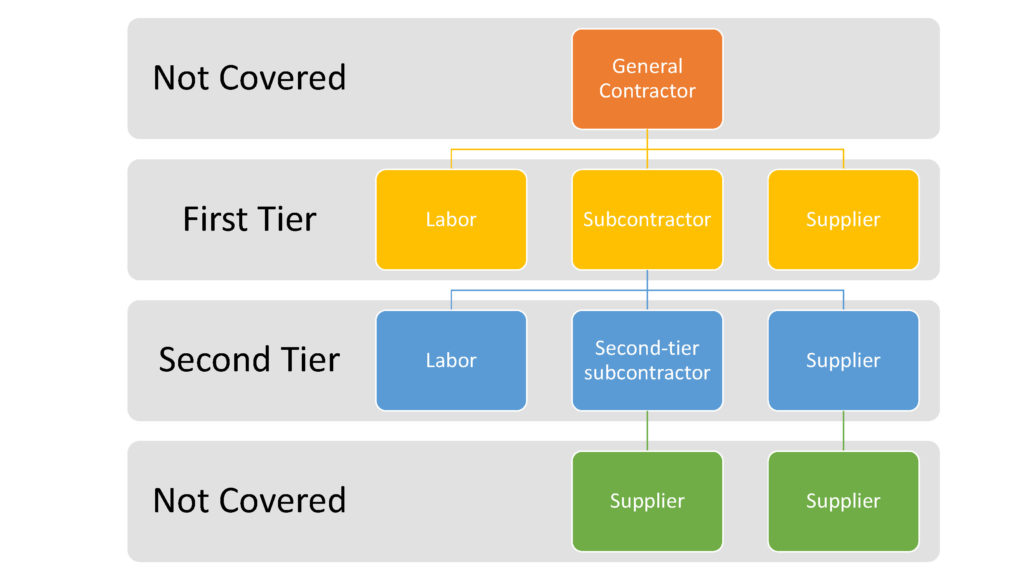

The Miller Act is a Federal law enacted in 1935. It requires payment bonds for the “construction, alteration, or repair of any public building or public works of the United States” that are for an amount greater than $100,000. However, the payment bond is not available to just any contractor on a Federal project. Payment bonds only cover persons who are: Miller Act and the Little Miller Act provide an alternative mechanism to help subcontractors and material suppliers providing work to applicable general contractors on certain public projects get paid. These laws require a bond to stand in place of the mechanic’s lien right. The bond requirement:

- “first tier” claimants, dealing directly with the prime contractor; and

- “second tier” claimants, supplying labor or materials to a subcontractor of the prime contractor.

How do you make a Miller Act claim for payment?

Your status as a first- or second-tier claimant affects whether and when you notify the prime contractor of your claim.

If you are a first-tier claimant, you are not required to send a notice to preserve your rights; however, it is wise to send notice nonetheless. You have one year from the last date that you furnished labor and materials to file a lawsuit against the bond.

If you are a second-tier claimant, you must provide written notice to the prime contractor within 90 days from the date on which you last supplied labor or materials for which you are making your claim. The notice is specific, and it must contain certain information with substantial accuracy such as the amount claimed, the name of the party to whom the material was furnished or supplied or for whom the labor was done or performed. The contractor must be served with the notice within the 90-day time limit. The notice can be served by any means that provide written, third-party verification of delivery to the contractor at any place the contractor maintains an office or conducts business.

After you serve notice, you should follow up with the surety and be prepared to provide backup for your claim along with signed form under oath substantiating your claim.

If the bond company or surety rejects your claim, you will have to file suit to enforce your Miller Act claim.

What is the Little Miller Act and when does it apply?

State legislatures have enacted laws similar to the Miller Act to provide an alternate source to subcontractors and material suppliers who work on state public work projects to recover payment. These laws are known as Little Miller Act. While the Little Miller Act is modeled after the Federal Miller Act, there are important differences between the two. In addition, Little Miller Act claims vary from state to state. For instance, the Maryland Little Miller Act extends to claimants who are a tier lower than the Federal Miller Act or the Virginia Little Miller Act.

3 steps you must take if working on a public project

If you perform work on a public project, make sure that you do the following:

- You should obtain a copy of the payment and performance bonds on the project before you start work. Know the contracting officer on the project and the name and contact information of the bond company.

- Keep detailed and accurate records for the project including time sheets, invoices, applications for payment, the contract and any amendments, change orders, and project correspondence. You will need these records to substantiate your claim should you have one.

- Time limits under the Miller Act and Little Miller Acts are strictly applied. Thus, keep careful and detailed records of the last day of work.

The Miller Act and the Little Miller Act probably are important and effective tools available to contractors and suppliers to get paid on public works projects. To take advantage of these laws, it is critical that you know and understand the technical requirements to perfect the claim; otherwise, you risk losing your right to assert the claim or recover under the bond.