August 15th, 2024

39 Stein Sperling Attorneys Listed in 2025 Best Lawyers and Best Lawyers: Ones to Watch

Stein Sperling is pleased to announce that 25 lawyers have been included in the 2025 Edition of The Best Lawyers in America®. Additionally, 14 lawyers have been included in the 2025 Edition of Best Lawyers:…

June 1st, 2024

May Federal Tax Updates

INDIVIDUALS In Excelsior Aggregates LLC v. Commissioner, TC Memo 2024-60, in a decision applied to 13 cases, the Tax Court doubted the value of conservation easements restricting sand and gravel mining and reduced the deduction…

May 31st, 2024

Celebrating Web Designer Day: The Craft Behind Modern Websites and Legal Considerations

Web Designer Day, observed annually on May 31st, honors the imaginative individuals who create the websites we rely on daily. Modern web design goes beyond mere aesthetics, encompassing user experience, accessibility, and mobile responsiveness. In…

May 23rd, 2024

U.S. Department of Labor’s Expansion of Overtime Eligibility Goes Into Effect July 1

UPDATE: Federal Court Strikes Down DOL’s Salary Threshold Increases for Overtime Exemptions The U.S. Department of Labor (DOL) announced a final rule on April 23, 2024, that will increase the salary thresholds for the “white…

May 22nd, 2024

Road Trip Ready: What to Do If You’re in a Car Accident This Summer

With Memorial Day marking the unofficial start of summer and the travel season heating up, roads will be bustling with vacationers. According to traffic safety data, summer and fall months generally see higher numbers of…

May 9th, 2024

Senior Fraud Awareness Day: Ensuring Your Loved Ones Aren’t Victims

Did you know seniors lost an estimated $3.1 billion annually to financial scams and fraud? Shockingly, the total losses of fraud reported by elderly victims have increased 84% since 2021. May 15th is National Senior…

May 1st, 2024

April Federal Tax Updates

INDIVIDUALS In Estate of Finnegan v. Commissioner, TC Memo 2024-42, the Tax Court concluded that settlement proceeds paid by a state as a result of improper findings of abuse and neglect of their children were…

April 25th, 2024

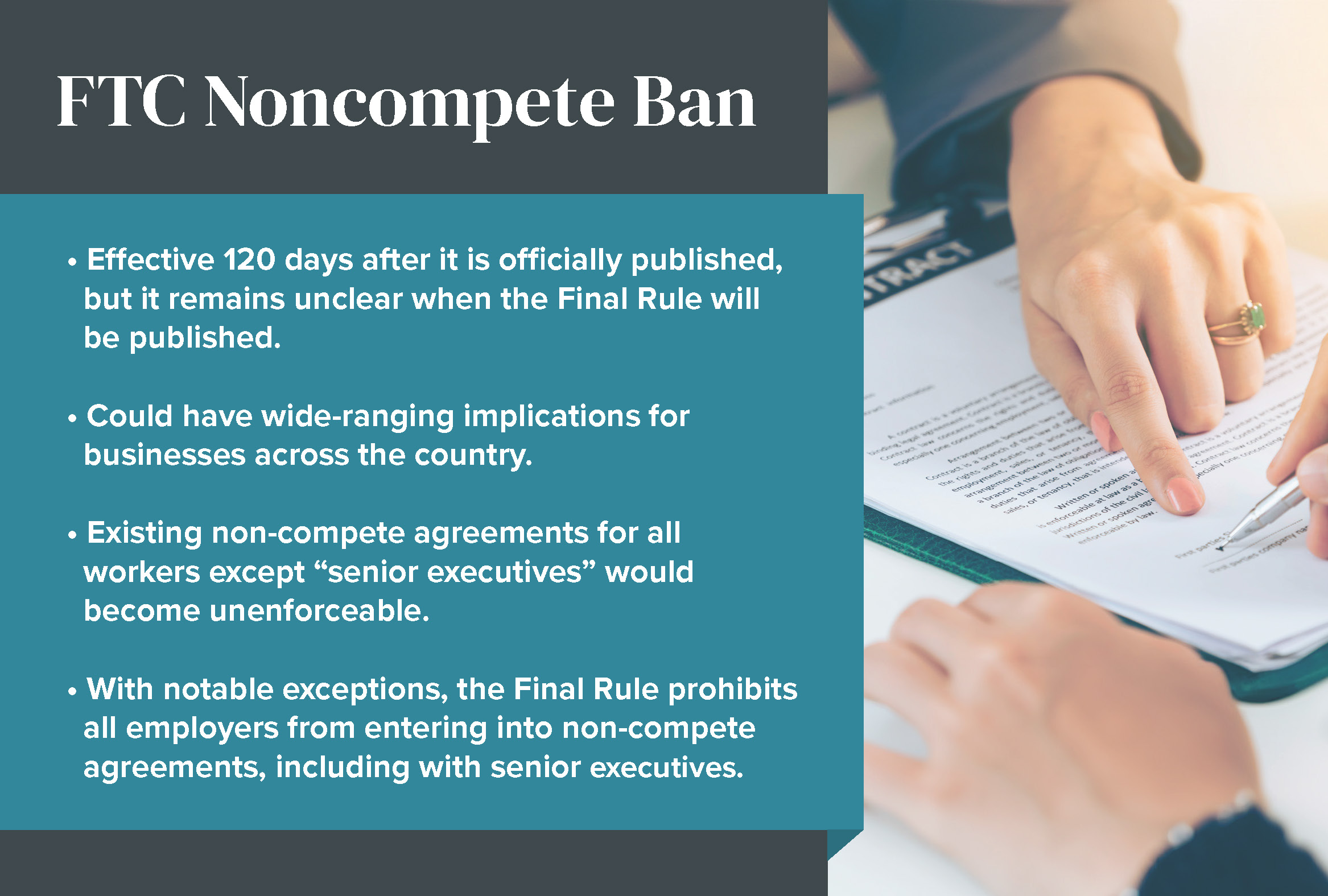

FTC Issues Ban on Noncompete Agreements

On April 23, 2024, the Federal Trade Commission (FTC) announced a Final Rule, applicable to for-profit employers, that would prohibit the enforcement of most “noncompete” clauses—those clauses that prohibit “workers” from seeking or accepting competing…

April 15th, 2024

To Be Blunt: The Dormant Commerce Clause Held To Not Apply to Maryland’s Social Equity Cannabis Licensing Scheme

The below information is provided as an update on an important issue developing with respect to Maryland’s cannabis industry. However, if you are interested in starting a cannabis-related business or providing ancillary services to a…

April 9th, 2024

Podcast: David De Jong Talks About Tax Implications of Catching a Record-Breaking Baseball

As the Major League Baseball season kicks off, tax attorney David De Jong shares insights with Money Life with Chuck Jaffe on what you have to consider from the tax perspective if you’re fortunate enough…