October 20th, 2020

Tax Considerations When Living or Working in Israel or Abroad

Tax attorneys Mark Schweighofer and Jeremy Vaida examine some of the most vexing tax and reporting considerations facing U.S. citizens living and working in Israel and elsewhere.

August 21st, 2020

16 Stein Sperling Lawyers Named to 2021 Best Lawyers List, 8 on Ones to Watch List

Stein Sperling Bennett De Jong Driscoll PC is pleased to announce that 16 lawyers have been included in the 2021 Edition of The Best Lawyers in America©. Additionally, eight attorneys received 2021 Best Lawyers: Ones…

August 18th, 2020

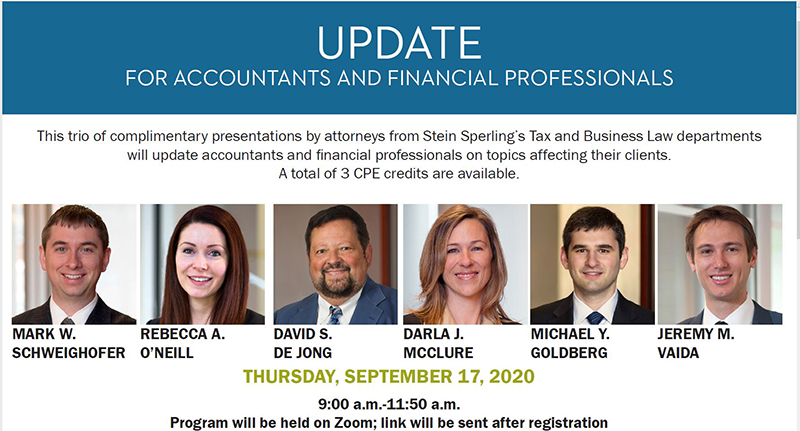

September Update for Accountants and Financial Professionals

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available. PPP…

June 8th, 2020

Paycheck Protection Program Flexibility Act of 2020

On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act of 2020 (“Act”), which amends key provisions of the Small Business Act and the CARES Act that relate to the…

May 19th, 2020

Updated PPP Loan Forgiveness Guidance from SBA

On May 15, 2020, the Small Business Administration (“SBA”) issued much anticipated guidance—in the form of a Loan Forgiveness Application and instructions—to calculate potential forgiveness amounts for loans issued pursuant to the Paycheck Protection Program…

April 15th, 2020

Tips for Spending PPP Loan Proceeds and Maximizing Loan Forgiveness

Jan. 12, 2021 Update: New COVID-19 Relief Legislation Contains Paycheck Protection Program Modifications The Payroll Protection Program (PPP) has provided a critical lifeline to businesses and their employees. Business owners whose PPP loan applications have…

April 10th, 2020

Recorded Webinar: Tax Provisions of P.L. 116-136 The CARES Act And Other Current Federal Tax Relief

Stein Sperling’s tax and business attorneys David De Jong and Mark Schweighofer review the federal tax developments related to the COVID-19 relief legislation. If you have questions, please contact David De Jong or Mark Schweighofer.…

April 6th, 2020

Mark Schweighofer interviewed in Forbes on CARES Act

Micah Solomon Senior Contributor with Forbes.com, interviewed Tax and Business attorney Mark Schweighofer on the Paycheck Protection and Economic Injury Disaster Loan programs. In Solomon’s article, “Free Money for Small Business: Two Loans You May…

December 16th, 2019

28 Stein Sperling Attorneys on 2020 Maryland Super Lawyers List

Stein Sperling is proud to announce 28 of its attorneys have been selected for inclusion on the 2020 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…

October 31st, 2019

20 Stein Sperling Attorneys Listed Among “Top Attorneys 2019” in Bethesda Magazine

In their November/December 2019 edition, Bethesda Magazine published a list of top attorneys in Montgomery County. 20 Stein Sperling attorneys—in the areas of Business/Corporate Law, Civil Litigation, Criminal Defense, Family Law, Personal Injury and Trusts…