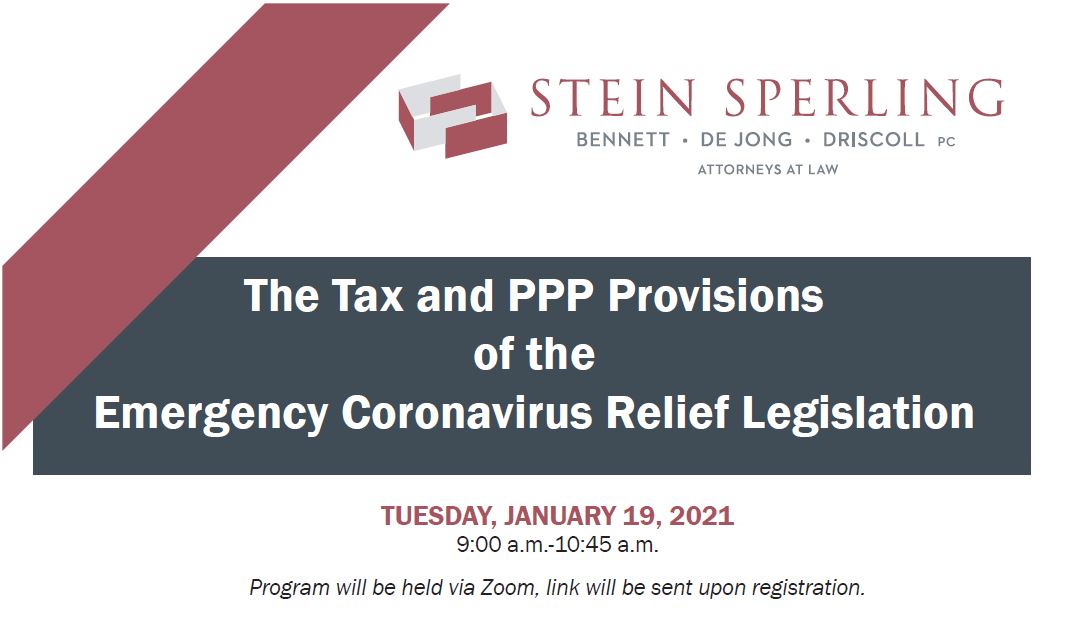

Event Date: Tuesday, January 19, 2021

The Tax and PPP Provisions of the Emergency Coronavirus Relief Legislation

Posted in: Featured Tax Law Events Tagged: David S. De Jong, Jeremy M. Vaida, Mark W. Schweighofer

Time: 9 a.m.-11:40 a.m.

Speaker: David S. De Jong, Mark W. Schweighofer and Jeremy M. Vaida

Besides overriding the IRS and permitting the deduction of wages and other expenses paid with forgiven PPP loans, the long-anticipated Emergency Coronavirus Relief Legislation contains numerous other tax provisions such as a second recovery rebate and a 2-year renewed deduction of 100 percent of business meals. PPP provisions modify the existing program and create a new tranche of loans. Stein Sperling principals David De Jong and Mark Schweighofer have selected the most important tax and PPP changes from the law’s 5500-plus pages.

A total of 2 CPE credits are available. Code words will be provided for proof of attendance.

Bonus Session Added: Maryland Passthrough Entity Tax: Planning Around the $10K SALT Limitation

On November 9, 2020 IRS surprised the tax community by blessing in principal a “workaround” to the ceiling on state taxes as an itemized deduction in the form of a state tax at the entity level on partnerships, LLCs and S corporations. Earlier in the year Maryland had enacted such an optional tax with a credit against liability on the owner’s return. This session presented by Jeremy Vaida will examine the law, the issues in opting for entity level taxation and, most importantly, a line by line look at the applicable Maryland forms. 1 CPE credit is available for the bonus session.