Date of Event: Tuesday, January 10, 2023

What Financial Professionals Need to Know About The Secure Act 2.0

The Secure Act 2.0, part of the omnibus spending legislation, makes numerous changes in the retirement plan law. It raises in 2023 the usual age when minimum distributions must commence to 73. It increases the…

April 20th, 2022

Your Questions on Tax Exempt Organizations, Answered

Help your clients navigate the complex and evolving tax laws and regulations unique to the tax-exempt world so they can avoid jeopardizing their tax-exempt status. Watch Stein Sperling tax and business attorneys Mark Schweighofer and…

Date of Event: Tuesday, January 19, 2021

The Tax and PPP Provisions of the Emergency Coronavirus Relief Legislation

Besides overriding the IRS and permitting the deduction of wages and other expenses paid with forgiven PPP loans, the long-anticipated Emergency Coronavirus Relief Legislation contains numerous other tax provisions such as a second recovery rebate…

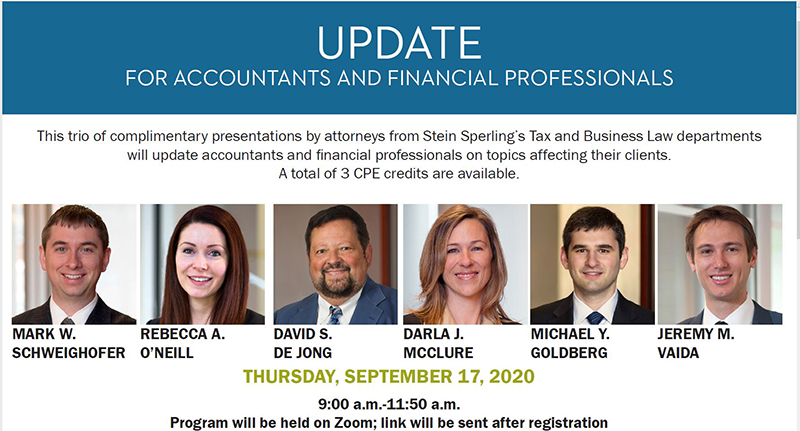

Date of Event: Thursday, September 17, 2020

September Update for Accountants and Financial Professionals

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available. PPP…

Date of Event: Tuesday, October 22, 2019

October Update for Accountants and Financial Planners

This trio of presentations by attorneys from Stein Sperling’s Tax Law department will update accountants and financial planners on topics affecting their clients. A total of 3 CPE credits are available. Cryptocurrency and the IRS…