August 18th, 2020

Tax Planning for a Possible Joe Biden Presidency

With Election Day just over two months away and the end of 2020 following two months later, it’s not too soon to consider the landscape of the tax law in the event of a Joe…

August 10th, 2020

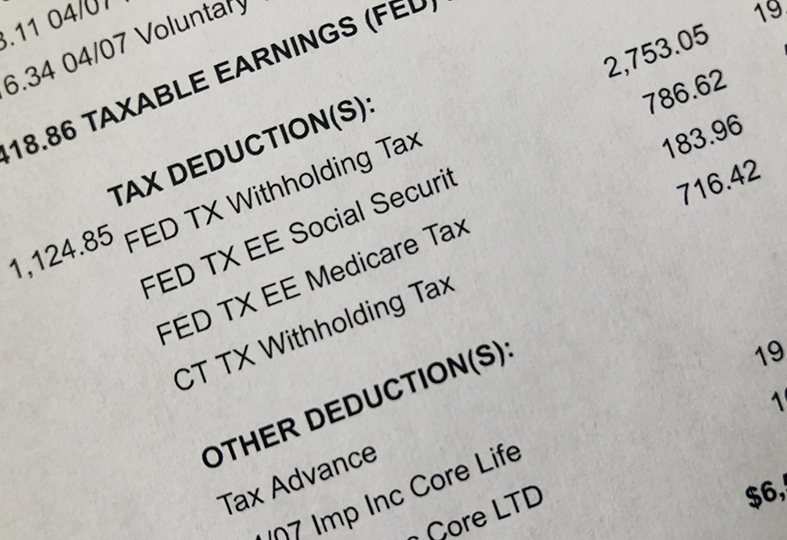

Executive Order Suspends Collection of Certain Employee Payroll Taxes

President Trump issued an Executive Order on August 8, 2020, postponing the withholding, deposit and payment of the employee portion of Social Security taxes from September 1, 2020 until after yearend in the case of…

July 16th, 2020

Moving to Israel (Aliyah) – A U.S. Law Primer

You are a U.S. citizen, your bags are packed, your documents are in order, and you are about to boardyour flight on El‐Al. A few hours from now you will be touching down, ready to…

June 8th, 2020

Paycheck Protection Program Flexibility Act of 2020

On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act of 2020 (“Act”), which amends key provisions of the Small Business Act and the CARES Act that relate to the…

June 4th, 2020

IRS Grants Further Relief – Extends People First Initiative

In light of continued economic hardship facing Americans, the IRS has extended its People’s First Initiative, effectively granting continued tax collection relief beyond the previously identified July 15th deadline. Key benefits to the People’s First…

May 22nd, 2020

Flexible Spending Arrangements Become Even More Flexible

To assist in recovery from COVID-19, IRS announced in Notice 2020-29 that unused amounts from 2019 for medical costs or dependent care in a cafeteria plan may be utilized for expenses incurred through December 31,…

May 22nd, 2020

Maryland Enacts a “Work-around” to Increase the Deduction for Taxes

Maryland has become the seventh state to allow pass-through entities such as partnerships, limited liability companies and S-corporations to elect to be taxed at the entity level as a “work-around” to the $10,000 cap on…

May 22nd, 2020

Business Valuations in COVID-19 World

In a matter of months, COVID-19 has had lasting effects on the economy and businesses requiring business valuators to consider its impact. On January 20, 2020, China recorded the first confirmed case of COVID-19. By…

May 19th, 2020

Updated PPP Loan Forgiveness Guidance from SBA

On May 15, 2020, the Small Business Administration (“SBA”) issued much anticipated guidance—in the form of a Loan Forgiveness Application and instructions—to calculate potential forgiveness amounts for loans issued pursuant to the Paycheck Protection Program…

April 29th, 2020

From Eligibility to Child Support: Stimulus Check FAQ

The 2020 Coronavirus Aid, Relief and Economic Security Act (CARES Act) includes a provision allowing some Americans to receive funds directly from the government to help cushion the economic damage inflicted by the COVID-19 pandemic.…