March 16th, 2020

What the “Families First Coronavirus Response Act.” Means for You and Your Business

UPDATED 3/26/2020: President Trump has just signed into law the revised “Families First Coronavirus Response Act.” The Act becomes effective on April 1, 2020, so employers should immediately begin preparations to ensure compliance with the…

November 6th, 2019

Stein Sperling Included in 2020 U.S. News – Best Lawyers “Best Law Firms”

Stein Sperling has been ranked in the 2020 U.S. News – Best Lawyers® “Best Law Firms” list nationally in three areas and regionally in eight areas. Firms included in the 2020 “Best Law Firms” list…

August 29th, 2019

Pay Your Taxes or Lose Your Passport

The Internal Revenue Service has recently begun seeking the revocation of passports of taxpayers who owe back taxes. Previously, the IRS had only been certifying those with seriously deliqunent tax debt to the State Department…

August 15th, 2019

14 Stein Sperling Lawyers Named to 2020 Best Lawyers List

Stein Sperling Bennett De Jong Driscoll PC is pleased to announce that 13 lawyers, Millard Bennett, Julie Christopher, David De Jong, Kathryn Deckert, David Driscoll, Monica Garcia Harms, Ann Jakabcin, Matthew Pavlides, Jeff Schwaber, Andrew…

June 6th, 2019

Stein Sperling Attorneys Appear on Federal News Network’s For Your Benefit

Stein Sperling tax attorney David De Jong and estates and trusts attorney Steve Widdes spoke with host Bob Leins on his radio show For Your Benefit on the Federal News Network. The June 3 episode,…

April 8th, 2019

Tax Attorney Eric Rollinger Speaks on The Divorce Chronicles Podcast

Stein Sperling’s Eric Rollinger joined Tracey Coates for an interview on the Top 8 Changes to Family Law with the Passage of the Tax Cuts and Jobs Act on her podcast, The Divorce Chronicles. In…

January 7th, 2019

Big Changes to Divorce: Alimony & Taxes

The Tax Cuts and Jobs Act signed into law in December 2017 is arguable the most significant revision of the Internal Revenue Code since 1986 and changes the tax treatment of alimony. Prior to the…

August 1st, 2018

U.S. Supreme Court Ends “Tax Free” Internet sales

The days of tax free internet sales are numbered after the U.S. Supreme Court recently ruled that South Dakota’s sales tax law on out-of-state sellers is constitutional. In South Dakota v. Wayfair Inc., the Court overturned…

April 20th, 2018

Stein Sperling Attorneys Interviewed on Tax Reform

Stein Sperling tax attorneys David De Jong and Mark Schweighofer and estates and trusts attorney Steven Widdes were interviewed by Montgomery Community Media, as part of their Small Business Network series, on “The Good, The…

March 14th, 2018

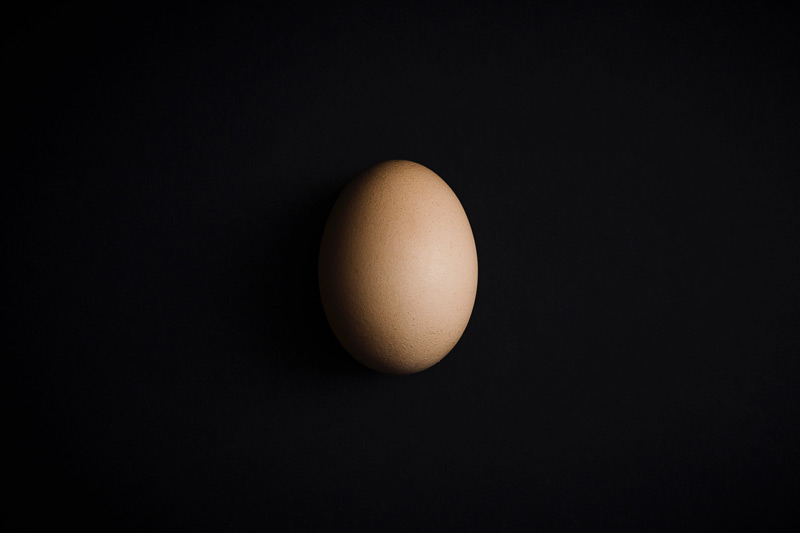

Representing the Troubled Taxpayer – Handling an “eggshell” audit

What is an “eggshell” audit? An eggshell audit is a civil IRS examination with underlying criminal issues. Representation during an eggshell audit should be limited to: tax controversy attorneys and CPAs under a Kovel agreement…