January 6th, 2021

Tax Provisions of the Emergency Coronavirus Relief Legislation

As part of the Consolidated Appropriations Act 2021, the lengthiest legislation in U.S. history at more than 5500 pages, Congress enacted further tax relief to those adversely affected by the coronavirus but including additional provisions.…

December 28th, 2020

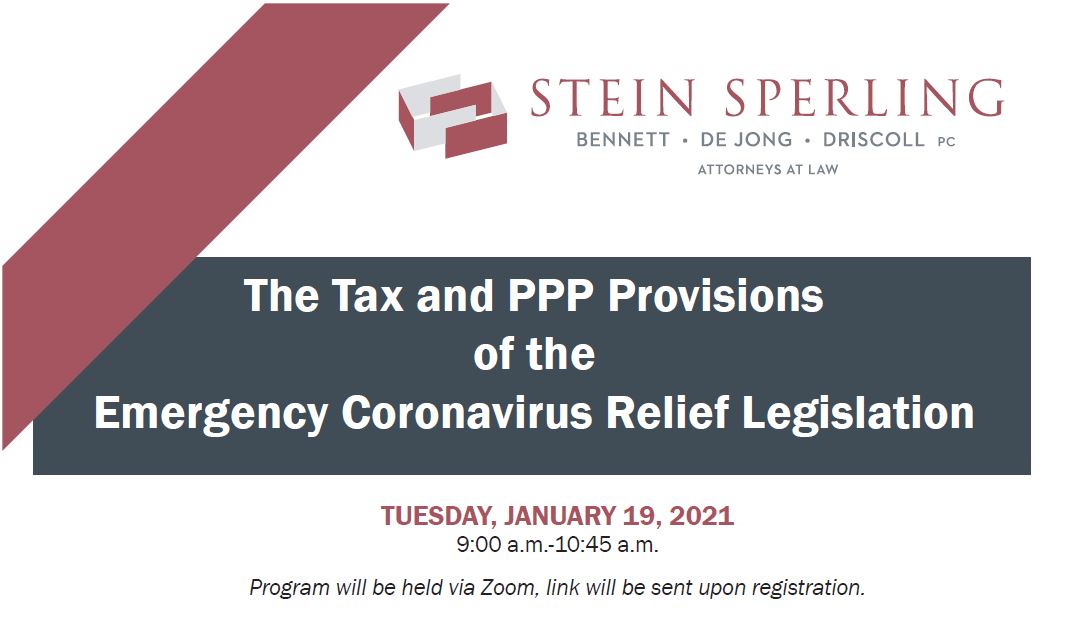

The Tax and PPP Provisions of the Emergency Coronavirus Relief Legislation

Besides overriding the IRS and permitting the deduction of wages and other expenses paid with forgiven PPP loans, the long-anticipated Emergency Coronavirus Relief Legislation contains numerous other tax provisions such as a second recovery rebate…

December 14th, 2020

31 Stein Sperling Attorneys Named to 2021 Maryland Super Lawyers List

Stein Sperling is proud to announce 31 of its attorneys have been selected for inclusion on the 2021 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…

August 21st, 2020

16 Stein Sperling Lawyers Named to 2021 Best Lawyers List, 8 on Ones to Watch List

Stein Sperling Bennett De Jong Driscoll PC is pleased to announce that 16 lawyers have been included in the 2021 Edition of The Best Lawyers in America©. Additionally, eight attorneys received 2021 Best Lawyers: Ones…

August 18th, 2020

Tax Planning for a Possible Joe Biden Presidency

With Election Day just over two months away and the end of 2020 following two months later, it’s not too soon to consider the landscape of the tax law in the event of a Joe…

August 18th, 2020

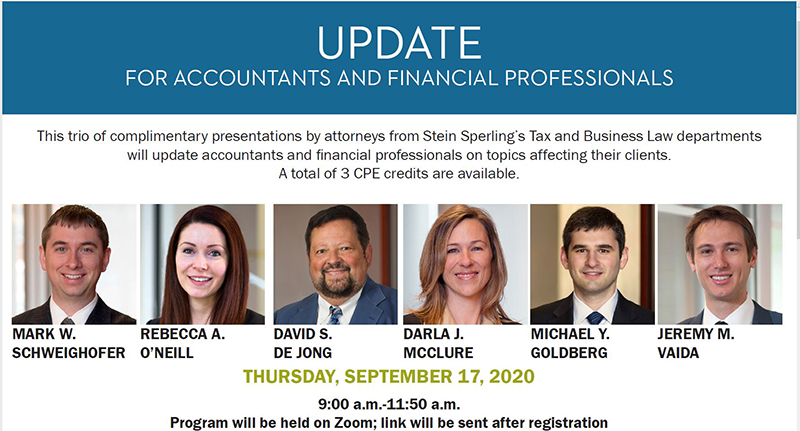

September Update for Accountants and Financial Professionals

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available. PPP…

April 10th, 2020

Recorded Webinar: Tax Provisions of P.L. 116-136 The CARES Act And Other Current Federal Tax Relief

Stein Sperling’s tax and business attorneys David De Jong and Mark Schweighofer review the federal tax developments related to the COVID-19 relief legislation. If you have questions, please contact David De Jong or Mark Schweighofer.…

March 16th, 2020

What the “Families First Coronavirus Response Act.” Means for You and Your Business

UPDATED 3/26/2020: President Trump has just signed into law the revised “Families First Coronavirus Response Act.” The Act becomes effective on April 1, 2020, so employers should immediately begin preparations to ensure compliance with the…

December 26th, 2019

The SECURE Act: Dramatic Changes in Retirement Rules & Other Late December 2019 Tax Provisions

After legislation languished for many months, Congress recently passed the Setting Every Community Up for Retirement Enhancement Act (SECURE Act). David De Jong and Steven Widdes with Stein Sperling’s Tax and Estates and Trusts departments…

December 16th, 2019

28 Stein Sperling Attorneys on 2020 Maryland Super Lawyers List

Stein Sperling is proud to announce 28 of its attorneys have been selected for inclusion on the 2020 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…