August 19th, 2020

Coming to America – A U.S. Law Primer for Israelis Moving to the United States

After years of telling everyone your quitting the Middle East balagan, you’ve finally got your visa to America! Your friends and family are already calling to tell you what they want you to bring back…

August 18th, 2020

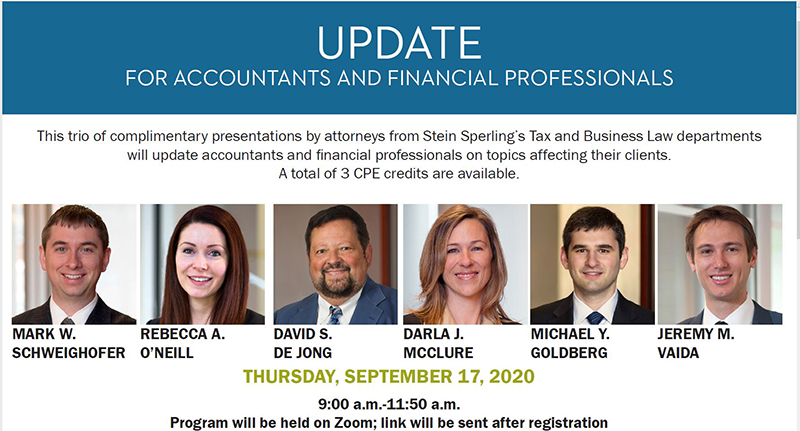

September Update for Accountants and Financial Professionals

This trio of complimentary presentations by attorneys from Stein Sperling’s Tax and Business Law departments will update accountants and financial professionals on topics affecting their clients. A total of 3 CPE credits are available. PPP…

July 16th, 2020

Moving to Israel (Aliyah) – A U.S. Law Primer

You are a U.S. citizen, your bags are packed, your documents are in order, and you are about to boardyour flight on El‐Al. A few hours from now you will be touching down, ready to…

March 25th, 2020

Maryland Comptroller and IRS Provide Tax Collection Relief in Response to COVID-19

Effective March 12th, 2020, the Maryland Comptroller halted certain tax collection efforts in response to the developing Corona virus outbreak. Specifically, the Comptroller will cease sending out lien warning notices, issuing liens, attaching bank accounts,…

December 16th, 2019

28 Stein Sperling Attorneys on 2020 Maryland Super Lawyers List

Stein Sperling is proud to announce 28 of its attorneys have been selected for inclusion on the 2020 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…

January 15th, 2018

Maryland’s Admission and Amusement Tax is No Joke

This article was originally published in the January 2018 edition of the Beverage Journal, a wine and spirits industry publication for Maryland for restaurant, tavern, social/private clubs and store owners. Maryland’s Admissions and Amusement Tax is…