October 31st, 2019

20 Stein Sperling Attorneys Listed Among “Top Attorneys 2019” in Bethesda Magazine

In their November/December 2019 edition, Bethesda Magazine published a list of top attorneys in Montgomery County. 20 Stein Sperling attorneys—in the areas of Business/Corporate Law, Civil Litigation, Criminal Defense, Family Law, Personal Injury and Trusts…

October 30th, 2019

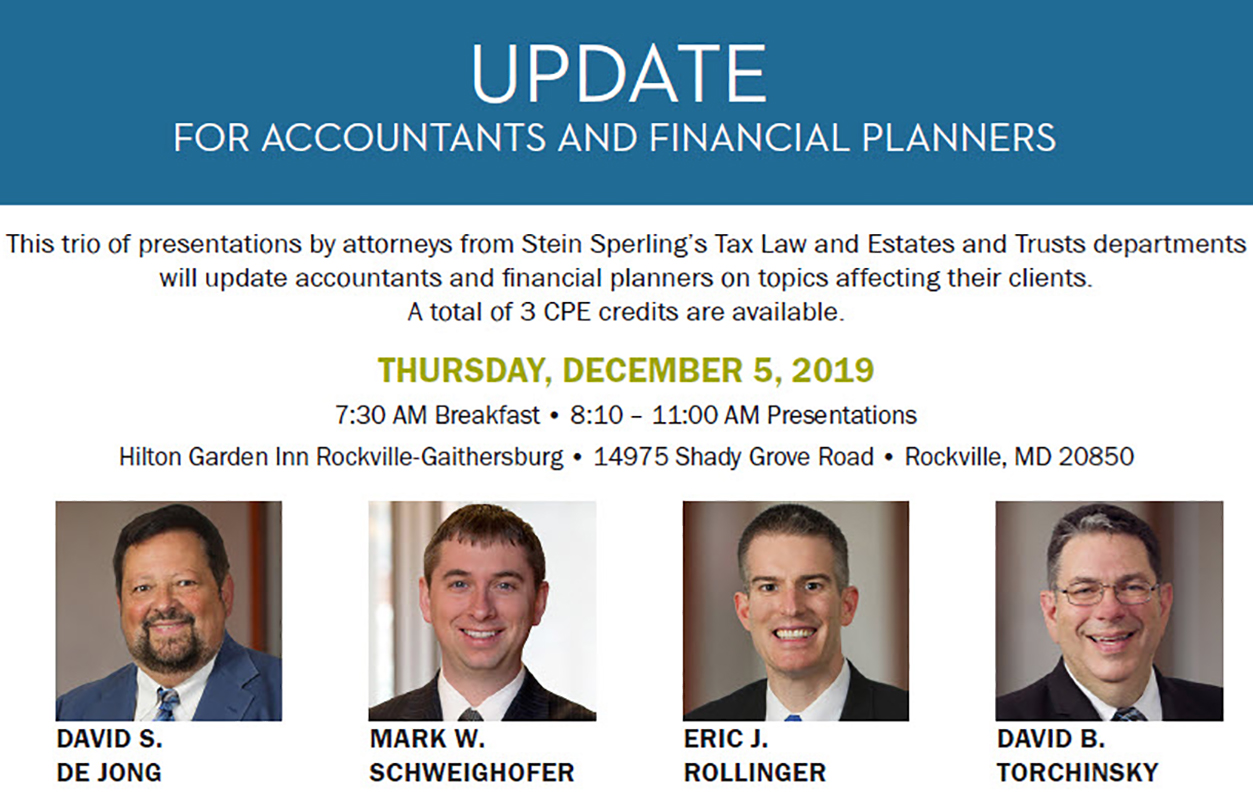

December Update for Accountants and Financial Planners

Three presentations by attorneys from Stein Sperling’s Tax Law and Estates and Trusts departments will update accountants and financial planners on topics affecting their clients. A total of 3 CPE credits are available. Top 15…

September 13th, 2019

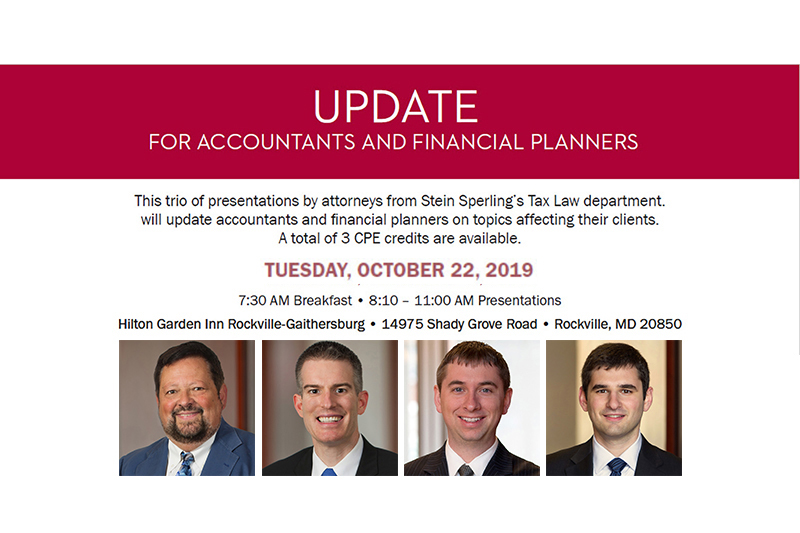

October Update for Accountants and Financial Planners

This trio of presentations by attorneys from Stein Sperling’s Tax Law department will update accountants and financial planners on topics affecting their clients. A total of 3 CPE credits are available. Cryptocurrency and the IRS…

August 15th, 2019

14 Stein Sperling Lawyers Named to 2020 Best Lawyers List

Stein Sperling Bennett De Jong Driscoll PC is pleased to announce that 13 lawyers, Millard Bennett, Julie Christopher, David De Jong, Kathryn Deckert, David Driscoll, Monica Garcia Harms, Ann Jakabcin, Matthew Pavlides, Jeff Schwaber, Andrew…

June 6th, 2019

Stein Sperling Attorneys Appear on Federal News Network’s For Your Benefit

Stein Sperling tax attorney David De Jong and estates and trusts attorney Steve Widdes spoke with host Bob Leins on his radio show For Your Benefit on the Federal News Network. The June 3 episode,…

January 1st, 2019

Update for Accountants and Financial Planners

This trio of presentations will update accountants and financial planners on topics affecting their clients. Attorneys from Stein Sperling’s Tax and Business Law groups will offer three sessions for a total of 3 CPR credits…

April 20th, 2018

Stein Sperling Attorneys Interviewed on Tax Reform

Stein Sperling tax attorneys David De Jong and Mark Schweighofer and estates and trusts attorney Steven Widdes were interviewed by Montgomery Community Media, as part of their Small Business Network series, on “The Good, The…

September 14th, 2017

Special Considerations in Valuing Professional Practices

IRS Circular 230 Disclosure The information contained in this presentation is not intended to provide Federal tax advice within the meaning of IRS Circular 230, but is a presentation prepared and/or designed to provide educational…

May 2nd, 2017

What Should You Do When You Get an IRS Audit Notice?

First, when you get a notice of audit from IRS, don’t panic. Although your return was among the less than 1% of all returns selected for audit, most examinations are limited in scope and have…