July 2nd, 2021

Key Issues to Consider Before Forming a 501(c)(3) Organization

Many philanthropic individuals looking to further their charitable endeavors, while also creating a meaningful legacy that can span generations, explore the possibility of forming a charitable 501(c)(3) organization. The term “501(c)(3)” refers to that section…

June 11th, 2021

David De Jong and Steve Widdes Speak on Estate Planning In Light of Proposed Legislation

On Monday, June 7, Stein Sperling tax and estate attorneys David De Jong and Steve Widdes joined host Bob Leins on Federal News Network’s ForYourBenefit show to talk about “Tax and Estate Planning Today – In…

March 31st, 2021

American Rescue Plan Act of 2021 Enacted

On March 11, 2021 President Biden signed into law a new COVID relief package which included a number of tax provisions: A $1,400 credit for individual taxpayers with an additional $1,400 for each dependent with…

March 26th, 2021

Tax Deadlines Extended for 2020 Tax Year

The Internal Revenue Service has extended the April 15, 2021 deadline for filing 2020 individual tax returns in light of continuing COVID-19 issues and the late start for processing returns. Individual 1040s will now be…

March 15th, 2021

Tax Alert: “Digital Products” Now Taxable in Maryland

As of March 14, 2021, Maryland undertakes the greatest expansion of its 6% Sales and Use Tax since its enactment by extending the tax to the sale of all “digital products.” Hoping to shore up…

January 6th, 2021

Tax Provisions of the Emergency Coronavirus Relief Legislation

As part of the Consolidated Appropriations Act 2021, the lengthiest legislation in U.S. history at more than 5500 pages, Congress enacted further tax relief to those adversely affected by the coronavirus but including additional provisions.…

December 14th, 2020

31 Stein Sperling Attorneys Named to 2021 Maryland Super Lawyers List

Stein Sperling is proud to announce 31 of its attorneys have been selected for inclusion on the 2021 Maryland Super Lawyers list, including attorneys on the Top 10, Top 50, and Top 100 lists. A…

November 6th, 2020

Stein Sperling listed in U.S. News – Best Lawyers “Best Law Firms” 2021

Stein Sperling has been ranked in the 2021 U.S. News – Best Lawyers® “Best Law Firms” list nationally in three practice areas and regionally in 11 practice areas. Firms included in the 2021 “Best Law…

October 20th, 2020

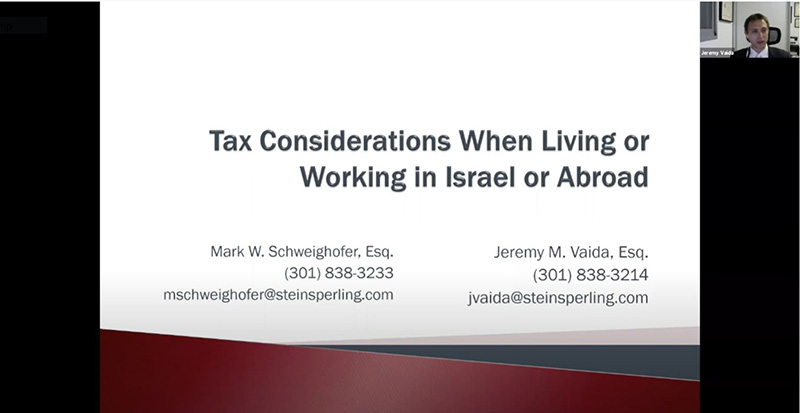

Tax Considerations When Living or Working in Israel or Abroad

Tax attorneys Mark Schweighofer and Jeremy Vaida examine some of the most vexing tax and reporting considerations facing U.S. citizens living and working in Israel and elsewhere.

August 19th, 2020

Coming to America – A U.S. Law Primer for Israelis Moving to the United States

After years of telling everyone your quitting the Middle East balagan, you’ve finally got your visa to America! Your friends and family are already calling to tell you what they want you to bring back…